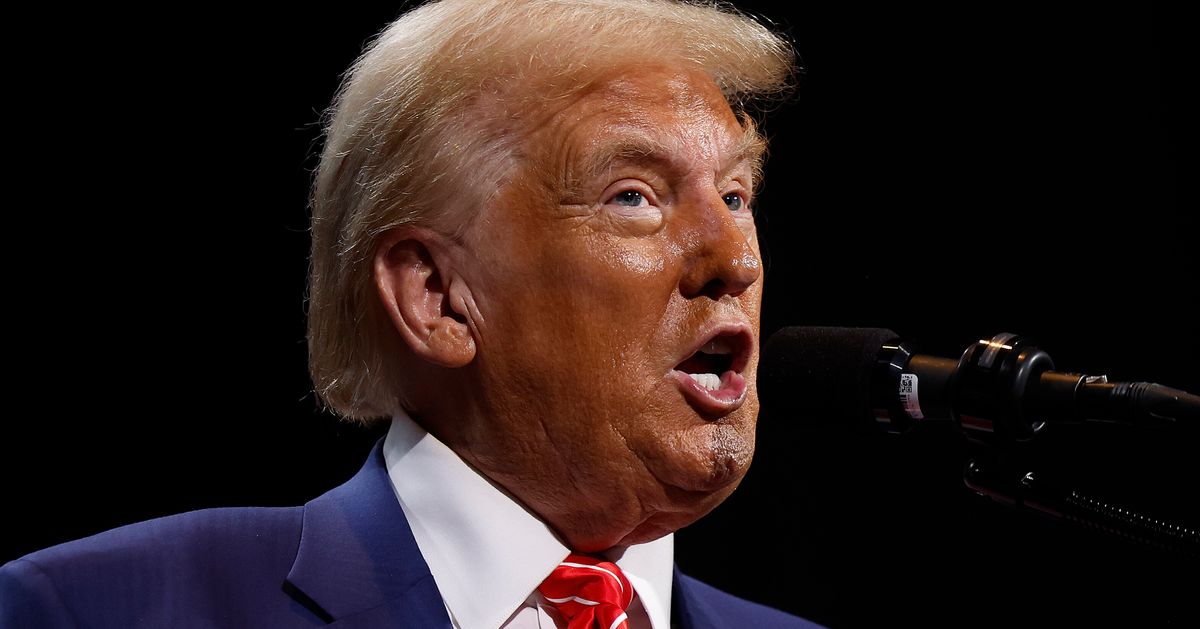

WASHINGTON (AP) — With attribute bravado, Donald Trump has vowed that if voters return him to the White Home, “inflation will vanish utterly.”

It’s a message tailor-made for People who’re nonetheless exasperated by the leap in client costs that started 3 1/2 years in the past.

But most mainstream economists say Trump’s coverage proposals wouldn’t vanquish inflation. They’d make it worse. They warn that his plans to impose large tariffs on imported items, deport hundreds of thousands of migrant staff and demand a voice within the Federal Reserve’s rate of interest insurance policies would seemingly ship costs surging.

Sixteen Nobel Prize-winning economists signed a letter in June expressing worry that Trump’s proposals would “reignite’’ inflation, which has plummeted since peaking at 9.1% in 2022 and is nearly back to the Fed’s 2% target.

Final month, the Peterson Institute for Worldwide Economics predicted that Trump’s insurance policies would drive consumer prices sharply higher two years into his second time period. Peterson’s evaluation concluded that inflation, which might in any other case register 1.9% in 2026, would as an alternative leap to between 6% and 9.3% if Trump’s financial proposals had been adopted.

Many economists aren’t thrilled with Vice President Kamala Harris’ financial agenda, both. They dismiss, for instance, her proposal to combat price gouging as an ineffective software in opposition to excessive grocery costs. However they don’t regard her insurance policies as significantly inflationary.

Moody’s Analytics has estimated that Harris’ insurance policies would go away the inflation outlook just about unchanged, even when she loved a Democratic majority in each chambers of Congress. An unfettered Trump, in contrast, would go away costs greater by 1.1 proportion factors in 2025 and 0.8 proportion factors in 2026.

Customers pay for tariffs

Taxes on imports — tariffs — are Trump’s go-to economic policy. He argues that tariffs defend American manufacturing facility jobs from overseas competitors and ship a bunch of different advantages.

Whereas in workplace, Trump began a commerce battle with China, imposing excessive tariffs on most Chinese language items. He additionally raised import taxes on overseas metal and aluminum, washing machines and photo voltaic panels. He has grander plans for a second time period: Trump needs to impose a 60% tariff on all Chinese goods and a “common’’ tariff of 10% or 20% on every little thing else that enters the US.

Trump insists that the price of taxing imported items is absorbed by the overseas international locations. The reality is that U.S. importers pay the tariff — after which usually move alongside that value to customers within the type of greater costs. People themselves find yourself bearing the associated fee.

Kimberly Clausing and Mary Pretty of the Peterson Institute have calculated that Trump’s proposed 60% tax on Chinese language imports and his high-end 20% tariff on every little thing else would, together, impose an after-tax loss on a typical American family of $2,600 a 12 months.

The Trump marketing campaign notes that U.S. inflation remained low at the same time as Trump aggressively imposed tariffs as president.

However Mark Zandi, chief economist at Moody’s Analytics, mentioned that the magnitude of Trump’s present tariff proposals has vastly modified the calculations. “The Trump tariffs in 2018-19 didn’t have as massive an influence because the tariffs had been solely simply over $300 billion in largely Chinese language imports,’’ he mentioned. “The previous president is now speaking about tariffs on over $3 trillion in imported items.″

And the inflationary backdrop was completely different throughout Trump’s first time period when the Fed anxious that inflation was too low, not too excessive.

Trump would reverse an immigration surge that helped ease inflation

Trump, who has invoked incendiary rhetoric about immigrants, has promised the “largest deportation operation″ in U.S. historical past.

Many economists say the elevated immigration over the previous couple years helped tame inflation whereas avoiding a recession.

The surge in foreign-born staff has made it simpler for fill vacancies. That helps cool inflation by easing the stress on employers to sharply elevate pay and to move on their greater labor prices by growing costs.

Web immigration — arrivals minus departures — reached 3.3 million in 2023, greater than triple what the federal government had anticipated. Employers wanted the brand new arrivals. Because the economic system roared again from pandemic lockdowns, corporations struggled to rent sufficient staff to maintain up with buyer orders.

Immigrants crammed the hole. Over the previous 4 years, the variety of folks in the US who both have a job or are in search of one rose by practically 8.5 million. Roughly 72% of them had been overseas born.

Wendy Edelberg and Tara Watson of the Brookings Establishment discovered that by elevating the availability of staff, the inflow of immigrants allowed the US to generate jobs with out overheating the economic system.

Previously, economists estimated that America’s employers might add not more than 100,000 jobs a month with out igniting inflation. However when Edelberg and Watson factored within the immigration surge, they discovered that month-to-month job development might attain 160,000 to 200,000 with out exerting upward stress on costs.

Trump’s mass deportations, if carried out, would change every little thing. The Peterson Institute calculates that the U.S. inflation price could be 3.5 proportion factors greater in 2026 if Trump managed to deport all 8.3 million undocumented immigrant staff considered working in the US.

A politicized Fed would make inflation-fighting more durable

Trump alarmed many economists in August by saying he would seek to have “a say” within the Fed’s rate of interest selections.

The Fed is the federal government’s chief inflation-fighter. It assaults excessive inflation by elevating rates of interest to restrain borrowing and spending, gradual the economic system and funky the speed of value will increase.

Economic research has discovered that the Fed and different central banks can correctly handle inflation provided that they’re stored unbiased of political stress. That’s as a result of elevating charges may cause financial ache — maybe a recession — so it’s anathema to politicians in search of reelection.

As president, Trump frequently hounded Jerome Powell, the Fed chair he had chosen, to decrease charges to attempt to juice the economic system. For a lot of economists, Trump’s public stress on Powell exceeded even the makes an attempt that Presidents Lyndon Johnson and Richard Nixon made to push earlier Fed chairs to maintain charges low — strikes that had been broadly blamed for serving to spur the power inflation of the late Nineteen Sixties and ’70s.

The Peterson Institute report discovered that upending the Fed’s independence would improve inflation by 2 proportion factors a 12 months.