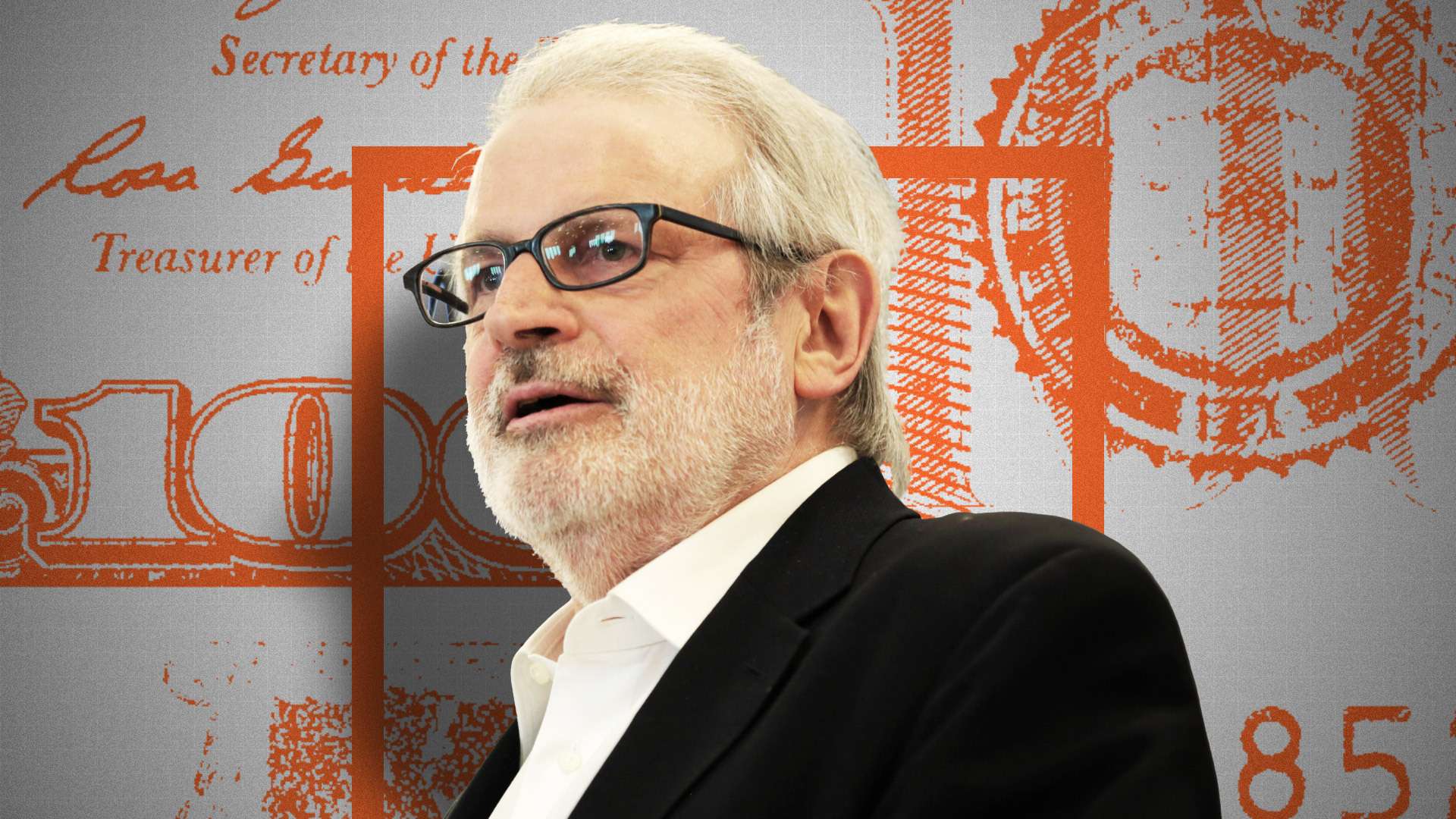

As Ronald Reagan’s first funds director, former Michigan congressman David Stockman led the cost to chop the scale, scope, and spending of the federal authorities within the early Nineteen Eighties. He made enemies amongst Democrats by pushing onerous for cuts to welfare applications—and he in the end made enemies amongst his fellow Republicans by pushing equally onerous to slash protection spending. His memoir of the period, The Triumph of Politics: Why the Reagan Revolution Failed, is a legendary account of how libertarian ideas acquired sacrificed on the altar of political expediency.

Stockman’s new e book is Trump’s War on Capitalism, and it takes a blowtorch to the previous president’s time in workplace. “In the case of what the GOP’s core mission must be…standing up for the free markets, fiscal rectitude, sound cash, private liberty, and small authorities at dwelling and non-intervention overseas,” he writes, “Donald Trump has overwhelmingly come down on the unsuitable aspect of the problems.”

At a Purpose Speakeasy occasion in New York Metropolis, Purpose‘s Nick Gillespie talked with Stockman about his political journey from being a member of College students for a Democratic Society who protested the Vietnam Battle to being one in every of Reagan’s foremost advisers to his denunciation of Donald Trump and his hope that Robert F. Kennedy Jr.’s candidacy helps throw the 2024 election into the Home of Representatives.

Stockman additionally explains how Trump led the cost on COVID lockdowns, acquired rolled by Wall Road and the Federal Reserve, and why his nativist views on immigration are inimical each to freedom and financial development.

Watch the full video here and discover a condensed transcript under.

Nick Gillespie: That is The Purpose Interview with Nick Gillespie. Thanks a lot for popping out. Our visitor tonight is David Stockman. He’s a former congressman, a two-termer from Michigan, south of Grand Rapids. Most likely greatest identified within the public eye for being Ronald Reagan’s first funds director who made the naive, idealistic, and completely fantastic mistake of believing that Ronald Reagan wished to chop the scale, scope, and spending of presidency throughout the board. He wished to chop the welfare-warfare state, proper?

David Stockman: Nicely, the welfare half.

Gillespie: And that is earlier than we get into his improbable e book, an actual stinging critique of Donald Trump, Trump’s Battle on Capitalism. In making ready for this, you as funds director, you got here in and also you needed to minimize $40 billion from a $700 billion funds in 1981. To provide you a way of how quaint that’s, the protection funds now could be about $700 billion. I believe we could also be approaching that simply in curiosity on the debt. However you had been scrounging round to seek out $40 billion to chop. What occurred?

Stockman: Nicely, I believe the issue was Ronald Reagan believed in small authorities profoundly, apart from the Pentagon aspect of the Potomac River. And he was actually a hawk, an actual, unreformed, unrequited Chilly Battle hawk. The protection funds was about $140 billion after we acquired there. By the point he left, it was $350 billion, an enormous enhance on the idea that the Soviet Union was creating first-strike functionality. None of that was true. That was the origination of the entire neocon view of the world. That is the place all these characters initially acquired their begin within the course of. And so, by the point we acquired to 1988, the protection funds had eaten up after which a few of all of the home cuts, and the Republicans who had been keen to face up for home spending cuts and title reforms and so forth had been so demoralized by seeing these huge will increase yr after yr for the Pentagon that they principally threw within the towel, and the entire thing was sort of a wipeout.

If you wish to get the numbers on it, simply to sort of cap off the purpose, when Jimmy Carter left the White Home in any case these years of huge spending by the Democrats, first Carter after which earlier than him, after all, [Lyndon B. Johnson (LBJ)], and weapons and butter and all the remainder, the home non-defense funds was 15.4 % of [gross domestic product (GDP)]. So means up, traditionally. When Reagan left, it was 15.3 %. So he made a 0.1 % distinction. And that is about all we acquired.

Gillespie: I might suggest everyone learn, The Triumph of Politics, David’s memoir of his time. The subtitle is Why the Reagan Revolution Failed and—in the event you’re serious about political financial system in addition to gossip—it is actually one of many nice memoirs.

However the e book we’re speaking about tonight is Trump’s Battle on Capitalism. The title says it so effectively there is not even a subtitle. Why do not you begin by telling us what was Trump’s battle on capitalism? He’s a businessman. He talked about having the best, the largest, one of the best financial system ever when he was president. What is the essence of Trump’s battle on capitalism?

Stockman: Nicely, the query I believe you are getting at is, why did I write it? And the reply is I had already written three books attempting to show the truth that Donald Trump is not remotely an financial conservative; he would not imagine in small authorities. I do not assume he believes in free markets. And positively he had no affinity by any means for sound cash or fiscal rectitude. So in 2016, I wrote a e book known as Trumped! to warn folks. In 2018, I wrote one other e book known as Peak Trump to say I used to be proper. In 2020, I wrote a 3rd e book known as Dump Trump. Nicely, the fourth time can be the appeal, proper? And the e book got here out 5 days earlier than the Iowa primaries. It was too late. However there’s a larger level to it, and that’s: We’re by no means going to get the sort of authorities, I believe, that every one of us imagine in—the sort of society, the sort of liberty, the sort of financial prosperity, the sort of market capitalism and so forth. Until there may be an sincere contest within the technique of democratic governance in the USA between one get together that roughly traces up as the federal government get together, the get together of state, the get together of the political class, the bureaucratic class, the apparatchiks in Washington. And there is a second get together that represents the hinterlands and the entire impulses that go together with us, to depart us alone, to tax us much less, to spend much less, to intervene much less, to get out of our means, to permit the non-public society and financial system to breathe. So we actually want a authorities get together contesting with an anti-government get together.

The issue is, right this moment we’ve got a uni-party when it comes to the first management within the Republican Get together in Washington. Once I take a look at [Mitch] McConnell, who’s been there 55 years on the federal government payroll, I can not actually inform any distinction between him and our senator from New York, the chief on the Democratic aspect. And so, what I believe the good hazard is that the issues in the USA right this moment when it comes to our place on this planet—which is a catastrophe when it comes to our public debt however we will get into quite a lot of these numbers in a minute—and when it comes to a rogue central financial institution that’s completely uncontrolled is that, if we do not deal with any of that, then [we will have continued rule of the uni-party], and we won’t have [that]. We have to break it up. However Donald Trump, regardless of all of his rhetoric and all of his loud boasting about draining the swamp and being the outsider and coming in to wash up the entire thing, is simply as a lot a statist in relation to all the important thing points. And we undergo them within the e book, in addition to many of the mainstream politicians in Washington.

So the very last thing we want is a battle in 2024 between Trump and Biden. It is pointless. It is ineffective. We have to have a clear break within the Republican Get together, blow it up if we’ve got to, and never permit the second get together in our democracy to be Trumpified. As a result of if it is Trumpified, then we get extra of what we had throughout the 4 years that he was there. I’ve acquired quite a lot of information on that, however let me simply cap it right here with one, after which we will go into among the particulars. When Trump was sworn in, the general public debt was $20 trillion already, and it had been swelling quickly for a number of many years. When he left, it was near $28 trillion. So let’s simply name it $8 trillion in 4 years. Now, somebody would possibly ask later, numbers of this magnitude are nearly onerous to understand, to know, however here is the way to perceive: The primary $8 trillion, equal to the $8 trillion that Trump racked up in 4 years, had taken from the primary day of the Republic to 2005 to approve. That’s, the primary 43 presidents in 216 years generated $8 trillion in public debt. Trump replicated that in 4 years, not solely due to big tax cuts that he did not attempt to offset with spending however due to the entire catastrophe of the pandemic, the COVID, the lockdowns, and $6.5 trillion price of bailout and aid and free stuff that got here out of the trouble to attempt to inform folks, “Yeah, we’re sending everyone dwelling. And don’t be concerned, we’ll ship you cash too.” So, that is the center of the matter.

Anyone that may generate $8 trillion in 4 years of further public debt, equal to the primary 43 presidents—and there have been some actual rascals, clearly, and dangerous guys in that lineup, together with [Franklin D. Roosevelt] and LBJ and quite a lot of others in between—that is the sort of quantity that grasps you by the collar and tells you, this man is a part of the swamp. He is not a part of the answer.

Gillespie: What’s unsuitable with working up huge debt?

Stockman: Somebody requested me that in 1970 after I first went to work on Capitol Hill. I ran for Congress in 1976 towards the outgoing [Gerald] Ford deficits, which had been massive. And the query was raised, and right here we’re. And it is now $34 trillion and rising and so, perhaps it is no downside in any case.

No, the reply is there are two methods to finance the deficit, each of them dangerous. The primary means is the sincere means: You financial it within the bond pits by borrowing out of the non-public financial savings stream. The impact of that, although, everyone understood after I was first on Capitol Hill within the ’70s and into the early ’80s, is that while you finance the general public debt deficits the sincere means, it causes crowding out. It forces up rates of interest greater and better, as a result of regardless of the given provide of financial savings is in the meanwhile. Uncle Sam is the sheriff. His elbows get first name on the cash. Crowding out occurs. Charges go up. That is the place we acquired the well-known bond vigilantes and so forth. And that is why, really, after we had been attempting to chop taxes within the early ’70s, what I known as the School of Cardinals—the established, seasoned Republican leaders within the Home: Bob Dole, Sen. [Pete] Domenici, Howard Baker, who was the Senate chief—they stated, “No, we have got to watch out right here, as a result of if we finance all of those tax cuts with purple ink and borrowing, we’ll crowd out non-public funding. We’re about to listen to from our automotive sellers who cannot finance their lot. We will hear from our dwelling builders whose prospects cannot get mortgages,” and so forth. So the purpose is, in the event you finance it the sincere means, you trigger crowding out, you get an early response economically. You principally suppress productive funding and also you shift society’s assets to “authorities funding”—in the event you assume that is a phrase, and I do not. I believe it is an oxymoron.

The sincere means of financing the deficits, which by the best way, needed to be accomplished within the late ’70s and early ’80s as a result of Paul Volcker was sitting within the chair on the Fed, and he was not about to monetize the debt. In consequence, we had an atmosphere by which the political response operate, the suggestions, was nearly instantaneous. Run huge deficits, drive up rates of interest within the bond pits. These unfold to the banking sector. These unfold to the hometown automotive sellers and homebuilders and SNL bankers and simply common customers. And it causes a political response that tends to create a constituency within the political system in Congress for reining within the deficit. That is the primary means.

The second means is to challenge all types of public paper and have the central financial institution purchase it. And that is known as monetization. And that is precisely what we have been doing ever because the late ’70s or late ’80s, successfully after Volcker left. And let me simply provide you with some thought of how a lot has been monetized. When [Alan] Greenspan took over, and also you bear in mind, that is 1987, he was allegedly at one time an amazing believer within the gold customary and an Ayn Rand disciple and different issues. He type of misplaced his financial rigidities. He was sort of nerdy. However in any occasion, the steadiness sheet of the Fed was $200 billion, and that is 1987. So it has one thing like 70 years of the Fed’s existence. It had taken 70 years to get to $200 billion. And I will speak loads in regards to the steadiness sheet of the Fed and other people say, “What does that imply? Why is that such an enormous deal?” The steadiness sheet of the Fed is just the monitor report of how a lot cumulative cash they seized out of skinny air and printed, fiat credit score, over time. So we had $200 billion.

To chop this story brief, till they determined that inflation was uncontrolled a few yr in the past and started to tug again, the steadiness sheet of the Fed had reached $9 trillion. Now, that is in a lifetime. I’m looking right here, I can see most likely fairly a couple of folks which may have been round in 1987. You went from $200 billion to that $9 trillion. That is 45 occasions development in that time period—a number of many years—at some extent when the GDP was solely growing by 5x.

So when the cash printed by the Fed goes up 45 occasions and the scale of the financial system goes up 5 occasions, you might be means, means, means, out of kilter, out of skew. And it’s that huge, steady cash printing which monetized the entire debt being created by a reckless Congress and White Home that allowed us to proceed to run these big funds deficits yr after yr. However finally it catches up with you as effectively.

There’s this well-known factor, I believe it is Hemingway’s e book the place he is requested, “How did you go bankrupt?” And the reply was, “Slowly at first, then swiftly.” What I am attempting to get at right here is the sincere strategy to finance the deficit will trigger issues in a short time. What we’re doing is the gradual means, however we have created huge monetary bubbles. Huge misallocation of assets, super quantities of hypothesis that ought to by no means occur in a wholesome financial system and would not occur. And it is permitted this to go on for much longer than would have been the case if we had accomplished it the sincere means. However, now we’re on the level the place I believe the chickens are coming dwelling to roost. Even the Fed has stopped printing cash as a result of inflation was uncontrolled.

Gillespie: So to deliver it again to Trump, Trump made an enormous deal about caring in regards to the forgotten man, speaking about Primary Road vs. Wall Road, all of that. Your e book makes the case that no matter he is saying, he is really serving to Wall Road or the monetary sector way over manufacturing sectors and repair sectors of the financial system. Speak slightly bit about his tariffs and his immigration coverage. He is attempting to assist small producers, saying we’ll preserve China from dumping low-cost merchandise right here so you may have your business right here. Why is that unsuitable?

Stockman: The massive irony about Trump is that he was the outsider who campaigned towards the established order, the institution, the deep state, and the political class. And that every one made for good rhetoric, and it really resonated with the general public. However while you take a look at what his coverage options are, they don’t have anything to do with draining the swamp. Trump’s fundamental tackle why all these folks had been left excessive and dry in flyover America and within the Rust Belt, and why we misplaced hundreds of thousands and hundreds of thousands of jobs, and why manufacturing goes to China and elsewhere is that this was all as a result of work of nefarious foreigners. Overseas governments that had been dishonest and unfair of their commerce practices. Immigrants coming throughout the border in hordes, who had been allegedly bloating our welfare state and undermining our financial system and undermining our safety.

Gillespie: That is at all times the good factor, proper? Immigrants are concurrently coming right here for welfare after which outworking us.

Stockman: Yeah. However see, the purpose is if you wish to drain the swamp, then you definately higher go to the swamp and alter the insurance policies. Ask what has triggered all of this dysfunction, mistrust, and failure. That may have pointed precisely to the Federal Reserve as a result of it has been pro-inflation because the ’70s. After which it made inflation official with its 2 % goal. And it was that pro-inflation coverage decade after decade that priced out the world market. It is that straightforward.

I take a look at one statistic that I’ve acquired within the e book that appears on the cumulative enhance in unit labor prices over the many years. And that is vital as a result of bear in mind what unit labor prices are: It is when wage price will increase—advantages and pay—[while productivity remains the same or decreases]. As a result of if in case you have wage will increase and you’ve got equal productiveness positive factors, then the price of manufacturing would not change. And a enterprise can go on and develop and thrive with out elevating the costs. But when wages are growing dramatically, extra quickly than productiveness, as a result of you may have a pro-inflation coverage being run by the central financial institution, then over time, unit labor prices get completely uncontrolled. And here is a startling quantity: From 1970 after we principally flushed sound cash down the drain at Camp David—in 1971, really, [Richard] Nixon [was president]—from then till the current, unit labor prices in the USA have risen 275 %. And on account of that, we’ve got priced ourselves out of the companies market as a result of the entire companies have gone to India and different low-wage international locations, to say nothing of the merchandise items market that has gone to Mexico and China and so forth.

I’ve one little factor within the e book that provides a fairly good instance. IBM was the good monster, the halfway at one level when it comes to making the pc {hardware}, which is the fashionable financial system. However between 1990 and the current, their employment in India has gone from zero to about 180,000, and their employment in the USA has been minimize by greater than a 3rd. So, that is on the companies aspect to say nothing of what occurred to those huge year-in, year-out, merchandise commerce deficits. Why did that occur? All of it occurred due to the unit labor prices growing at these charges. It occurred since you had a pro-inflation slightly than a pro-deflation central financial institution. And mockingly, it occurred as a result of Milton Friedman gave Richard Nixon—difficult Dick, as all of us fondly name him—some very dangerous recommendation. He stated, “OK, we’ll unlink the greenback from its base, from its hyperlink to gold. However don’t be concerned about that, as a result of the free market will care for alternate charges.” And what that basically meant was that if we inflated an excessive amount of domestically, relative to the remainder of the world, our alternate charge would go down. Hastily, the imports would price much more, our exports can be much less aggressive, and there can be a disciplining mechanism, a braking mechanism that might forestall big will increase within the commerce deficit and the offshoring of manufacturing. And that is what Friedman advised Nixon. Now, in concept, he was most likely proper, however in follow, he was totally unsuitable, as a result of what occurred over the past 5 many years is all of the central banks on this planet have engaged in soiled floats. And so there by no means was a free market.

Gillespie: Might you clarify what a grimy float is?

Stockman: A unclean float principally says, slightly than let the market clear when it comes to the alternate charge between, say, the greenback and the yen, or the greenback and the euro, or the greenback and Mexican peso, the central financial institution stepped in and tried to peg the alternate charge. They imagine in the event that they peg their alternate charges low, it will assist their export factories. It’s going to assist jobs. It’s going to assist prosperity. They will export extra to the remainder of the world. That is known as mercantilism. And what the Fed has accomplished after 1971 is unfold an enormous financial illness on this planet known as mercantilist financial coverage. I’ve acquired quite a lot of examples within the e book of why we have misplaced a lot manufacturing and jobs to Mexico—and to say nothing of China. [This is all] principally as a result of the Fed stated it is OK to govern your foreign money. It is OK to extend your home cash provide at big unsustainable charges as a result of we’re doing the identical factor right here. And in order we flooded the world with fiat {dollars}, the Fed’s steadiness sheet went—as I stated, simply in that brief time period—from $200 billion to $9 trillion. The remainder of the world, these different central banks, however notably the Asian ones and in addition the Persian Gulf, oil Petro central banks, purchased in {dollars} hand over fist. However the secret in that entire factor is after they had been shopping for {dollars} to maintain their alternate charge from rising, they had been principally promoting their very own foreign money to the home market. In different phrases, the Fed was exporting inflation, and the opposite central banks reciprocated by shopping for up the {dollars} and inflating their very own cash provides.

Now, why am I going into all this? As a result of that meant that what Friedman stated [about] the automated adjustment mechanism of the free market in alternate charges was short-circuited. It was blocked. And so the adjustment by no means got here, and in consequence, from 1974 onward, we’ve got not had one yr of a commerce surplus. And it is gotten worse and worse. And over that time period, it was $15 trillion of cumulative commerce deficits. And in the event you even throw within the surplus on companies that we’ve got on this planet, it is nonetheless $11 trillion over the past 40 years. Is 11 trillion an enormous quantity? Nicely, in the event you put it in right this moment’s buying energy, it is $20 trillion.

Due to this fact, principally, we’ve got borrowed $20 trillion from the remainder of the world to maintain this entire recreation going. So that is how we acquired into the mess, on commerce. And for this reason Trump, as I say within the e book, had it completely the wrong way up. The issue was, he would inform you, these nefarious evildoers within the U.S. Commerce Administration or within the Commerce Division or lobbyists sneaking across the banks of the Potomac that made dangerous commerce offers and gave away the shop with all of our opponents. And that is why we’re in such an enormous mess. And that in the event you put a man who actually is aware of the way to negotiate—as an example, not pay his payments, which is one in every of his negotiating strategies—in the event you put a tricky man like me within the Oval Workplace, I will negotiate good commerce offers. And earlier than you understand it, all the things goes to be higher. Nicely, he negotiated NAFTA, as you all bear in mind. There was quite a lot of hoopla about that. Principally, in the event you take a look at it, it simply acquired a brand new identify. Nothing modified. And secondly, in the event you take a look at what occurred to the deficit with Mexico, it doubled—

Gillespie: And is {that a} dangerous factor, although? I imply, he renegotiated NAFTA. We sort of acquired worse phrases on some stage, however we acquired extra stuff cheaply.

Stockman: Nicely, sure. I believe that is true. However there is a sure sort of libertarian free market and free commerce that ignores the financial aspect. There may be this level I used to make, and I believe half of it is legitimate and the opposite half is not. The purpose we used to make within the ’70s and ’80s was, effectively, if different international locations are silly sufficient to fill their harbors with rocks and figuratively cease commerce, why ought to we reciprocate and be as silly as they’re? Due to this fact, in the event that they need to subsidize their exports just like the Chinese language or others, extra energy to them as a result of they’re principally transferring wealth to our customers; home welfare is healthier off, and in order that’s nice. Nicely, that is half of the equation. However the different half of the equation is that when you may have a internet export imbalance of $20 trillion over a time period, you may have exported an enormous quantity of your manufacturing base to the remainder of the world. And except you may preserve borrowing at greater and better charges, that is not sustainable as an financial matter first, however as a political matter.

And that is the purpose. And you could assume it sounds slightly flippant, however I do not assume it’s. I believe that Milton Friedman was the godfather of Donald Trump, as a result of Milton Friedman principally advised Nixon, “Sever the hyperlink to gold”—I am the gold customary man, I believe you might need seen that—and [that] we need not fear in regards to the historic relic or barbarous relic or no matter [John Maynard] Keynes known as it, as a result of we’ve got a market—a free market that’ll set the alternate charges proper. Nicely, he was unsuitable about that. We exported huge quantities of our industrial base. We created a burned-out zone in a lot of the Rust Belt, the higher Midwest, Pennsylvania; New England was lengthy gone. I used to be from the auto state of Michigan, and you understand that was completely burned out. However the place did Trump get elected in 2016? On the margin, he acquired elected within the Rust Belt precincts of Pennsylvania, Michigan, Wisconsin, Iowa, in all of the locations that acquired left behind as a result of we had an unsustainable set of economics with the remainder of the world. And it was attributable to the central financial institution that Friedman was keen to let free.

Now, after all, Friedman thought that the entire central bankers, that’s, the members of the Fed, can be identical to him. They’d be Milton Friedman clones, and they’d be very punctilious in regards to the charge at which they had been increasing Fed credit score, and he had all types of guidelines of thumb and so forth. However after all, that was a pipe dream. That was naive. Individuals who would get appointed to the Fed are principally there to do the enterprise both of Washington politicians or Wall Road speculators.

I am probably not attempting to trash Milton Friedman as a result of he is an amazing hero—when it comes to free markets and the understanding of the rudiments of a free society, you may’t beat Milton Friedman. However the issue is he had a view of central banking and a view of the Federal Reserve that I believe was completely unsuitable and that turned the fulcrum for all of this stuff that occurred.

Gillespie: No matter has been occurring when it comes to financial development has been dangerous for some time, however you speak loads about TARP—how on the finish of the Bush administration and the start of the Obama ones, handouts to automakers had been locked into place. However may you speak slightly bit about how Trump did one thing comparable with COVID? Is a part of the issue that these elements of the American financial system get worn out as a result of they are not allowed to vary and adapt as a result of they get varied sorts of applications which might be designed to assist them make it by way of to the subsequent paycheck?

Stockman: Yeah. That is sort of the issue of crony capitalism. For anyone that is likely to be , I wrote a 640-page e book on that entire subject that was launched in 2013. However I believe the difficulty that we have to discover a strategy to perceive is that all the things goes again to central banking. And when the central financial institution makes it really easy to borrow cash, we find yourself with an financial system that when Greenspan left or acquired there, there was about $10 trillion of whole debt on the financial system, private and non-private. And that was lower than 200 % of GDP. Immediately it is $96 trillion. In different phrases, they’ve saved rates of interest so low, they’ve had such deep and long-lasting monetary repression that the financial system has grow to be an enormous [leveraged buyout (LBO)]. And while you do an LBO—I used to be within the non-public fairness enterprise, so I do know—there may be prosperity for a few years. But when issues do not work out proper, you are going to have curiosity funds that start.

Gillespie: To deliver it again to Trump’s particular insurance policies, he got here into workplace saying he was not solely going to cease unlawful immigration, however he was going to chop authorized immigration in half. What’s dangerous about that? Why is that a part of the battle on capitalism?

Stockman: Basically, it raises a complete challenge of supply-side coverage. And I used to be a supply-sider again within the Nineteen Eighties with Reagan. After which I acquired run out of the availability aspect church as a result of I did not observe all of the precepts precisely.

The difficulty that we’ve got right this moment, as to why development has been so tepid and why residing requirements have type of stagnated, why there are such a lot of very alienated folks on the market in flyover America eager to get behind Trump—the explanation that this has been taking place is as a result of we have got big deficiencies on the availability aspect of our financial system when it comes to labor and capital funding. You understand, the native-born work pressure is definitely shrinking. It peaked in 2015, and it is shrinking. And that is as a result of, for no matter causes, native-born ladies and households aren’t having infants. And so our labor pressure is shrinking, and since traditionally half of GDP development has been labor—the opposite half is productiveness—our financial system is grinding to a halt as a result of the labor provide is shrinking, except we permit immigrants who need to work to come back right here and grow to be a part of the work pressure.

I acquired a quantity that I believe is sort of startling while you hear in regards to the flood of immigrants coming in and that we’re being overrun and the way America’s being in some way turned the wrong way up. In the event you go to 1870, we lastly acquired out of the Civil Battle and all of the chaos that generated. There have been solely 39 million folks left in America—north, south, all of the states after the union reunited. Over the subsequent 40 years to the eve of World Battle I, we had 25 million immigrants. So, relative to the inhabitants in 1870, the immigrant inhabitants in a couple of many years was two-thirds of the inhabitants to start with. Now, what number of immigrants do we’ve got right this moment? We’ve authorized immigrants of about slightly over one million. We’ve a inhabitants of 335 million folks. So immigration right this moment is lower than one-third of 1 % [of the population], not 66 % or 60 %.

That is the primary level. The second level is we’ve got a very damaged, ridiculous, immigration coverage that comes proper out of the swamp in Washington, and if Trump actually understood what he was saying when he stated, “I will drain the swamp,” the very first thing you’ll do can be to vary the premise for immigration. To get right here, you both must be a household unification, which is about 400,000 out of the million, or you must be a Ph.D. or some high-tech expert employee to get a pair hundred thousand extra slots, or, and that is the large or, you must be a refugee or an asylee. That is the one means that unskilled staff can get into the USA right this moment, after we desperately want unskilled and low-skilled staff, as a result of our native work pressure is declining.

Within the final yr that the information is obtainable, 2022, solely 4,000 inexperienced playing cards had been issued underneath the class of issues known as E3 and E6, for unskilled staff; 4,000 out of the 1,118,000 authorized immigrants that acquired right here, to say nothing of the hordes littered on the border. Now, the hordes on the border, in the event you look—in the event you can stand it—at Fox Information each night time, most of them are fairly strong-back to able-bodied younger folks, and their households are middle-aged. Nevertheless it’s an unskilled, low-skilled work pressure on the lookout for a job and a greater financial alternative. However the coverage is equal to attempting to drive a dump truck by way of a pinhole.

In different phrases, there are hundreds of thousands of individuals on the border attempting to come back in. There are solely 4,000 slots for unskilled staff, so all of them are on the border, being pressured to faux that they are asylees, that they are refugees. And the one means you may grow to be a refugee is to cross the border, break the legislation, get arrested, after which be put into the queue that takes months and months, the truth is, years of willpower in a very clogged up courtroom system with a purpose to get licensed that you just’re an asylum seeker. And you must show, as an example, that in the event you come from Costa Rica, you are in endangerment of life and limb in the event you keep.

I deliver up Costa Rica as a result of I checked the opposite day, it seems you may get a ticket from Costa Rica to Kansas Metropolis if there have been some job openings there for $214 a day. So if we had a visitor employee program of that sort that makes a lot sense right this moment that might permit folks to go to the U.S. consulate in Costa Rica, get a visitor employee allow, and be matched up with somebody seeking to rent folks for garden care work or warehouse work in Kansas Metropolis, they might get there for $214. No fuss, no muss. No chaos on the border. No border patrol folks chasing round in the midst of the night time. And we might open up that little pinhole to the financial rationality that we have to have.

In different phrases, [the system can be reformed simply] to make it economics-based slightly than asylum-based, which is politics. You probably have a visitor employee program and other people come right here and so they’re making the payroll and their employer is licensed month after month, yr after yr, after 10 years, I would say give them citizenship and allow them to keep. The entire downside can be solved.

The hordes on the border are hundreds of thousands of people that need to be financial immigrants however are being pressured to be political refugees, and so they’re creating a large number. And the explanation I discussed the $214 Delta ticket is that to get from Costa Rica to the Rio Grande, you must pay the coyote $4,000 to $10,000 to get you there, when Delta can be completely happy to do it for $214, if we had been solely sensible sufficient to have a rational, economics-based immigration system. However there you go once more. Immigration management, the entire byzantine, convoluted management system is statism at its worst. It is run by the lobbyists in Washington. Google will get everyone they need. They get all of the Ph.D.s, they get all of the sensible younger techies popping out of South Korea or Taiwan or wherever else they’re coming from. They care for their wants. The Fortune 500 takes care of their wants as a result of there are 4 or 5 classes for superior levels, Ph.D.s, uncommon expertise. All of them get in 3,000 or 4,000 a yr. However employers that must have folks working in fast-food joints or in garden care companies or in warehouses or in agriculture cannot get anyone right here legally. So that you get the entire mess that we’ve got right this moment.

Gillespie: So, Trump is terrible. I can not converse for this viewers. I do know for myself, I did not vote for Trump. I do not count on to vote for Trump. I am not transferring to Canada and I am not transferring to Cuba if he wins or something like that. However is not the choice as dangerous or worse? As a result of it should be Joe Biden.

Stockman: Nicely, if you must endure by way of one other Democratic administration, would possibly as effectively have a senile man within the chair, as a result of little or no goes to get accomplished. However that is slightly facetious. I believe from our perspective on this planet that 4 years will not be the tip of historical past, and that if we do not get a nonstatist or an anti-statist get together, reassemble, realign out of the mess of the uni-party that we’ve got right this moment, effectively then there actually isn’t any hope since you proceed to do the identical previous factor time and again, which [Albert] Einstein stated is the proper definition of madness. So I say, what we have to do in 2024 is blow up the Republican Get together. It must be purged. It’s a gang of cultural right-wingers, neocon warmongers, and principally profession politicians who use the get together as a fundraiser.

Gillespie: Do you continue to take into account your self a Republican?

Stockman: Nicely, I believe, no. This get together must go.

Gillespie: Within the e book, you talked about the drug battle is silly. Are you able to give us some rationalization in 10 seconds?

Stockman: I will provide you with three seconds. The drug battle is basically goddamn silly. And once more, that is a part of the entire Trump shtick. He got here down the escalator in 2015 speaking in regards to the murders and the rapists and the drug sellers coming throughout the border. As I lay out in my e book fairly clearly, if the drug a part of it’s a downside, decontrol medicine and let the teamsters ship the stuff in and let Philip Morris distribute. Preserve it authorized.

Carry it above floor. Make it authorized. Take out all of the premium revenue that principally goes to funding the felony organizations which might be necessitated when the federal government decrees {that a} desired product shall be artificially scarce. So, that is a part of all of the rhetoric too. I imply, all the things you hear about all of the medicine coming throughout, that could be a completely different challenge. And we have to separate them out, the economics of immigration vs. the economics of the silly battle on medicine and the drug management legal guidelines that we’ve got. Folks do not most likely bear in mind this—I do not assume any of us may, we have not been round lengthy sufficient—however till 1918, you did not have to have a passport to come back to America, OK? There have been no passports.

All of this immigration management actually started then, and it is created its personal forms and its personal set of politics. So if we acquired again to type of economically pushed border coverage, which was what we needed to our nice profit till 1923 after they handed the primary Immigration Act, most of this downside would go away.

This interview has been condensed and edited for model and readability.

- Video Editor: Adam Czarnecki

- Audio Manufacturing: Ian Keyser