President Donald Trump’s justifications for tariffs maintain shifting—one second they’re to cut the flow of illegal drugs and immigrants, the following, they’re to bolster American businesses and jobs. However the argument that appears to resonate most with the general public is that they are going to end in a stronger and extra aggressive U.S. financial system. Economists aren’t satisfied, to place it mildly. The actual fact is that American authorities is commonly the largest obstacle to the employees and employers that politicians declare to be serving to.

“Massive and protracted annual U.S. items commerce deficits have led to the hollowing out of our manufacturing base [and] resulted in a scarcity of incentive to extend superior home manufacturing capability,” Trump argued in an April 2 government order imposing stiff tariffs on many of the planet. “President Trump is working to stage the taking part in area for American companies and staff by confronting the unfair tariff disparities and non-tariff limitations imposed by different nations.”

You’re studying The Rattler from J.D. Tuccille and Cause. Get extra of J.D.’s commentary on authorities overreach and threats to on a regular basis liberty.

Obstacles To Commerce Come From Our Personal Authorities

However what if essentially the most insurmountable limitations for home companies and the roles they create come not from international governments however from homegrown regulators making an attempt to mould the financial system into their most popular kind? The truth is, entrepreneurs and executives at established corporations complain bitterly in regards to the prices of pleasing elected officers and authorities staff who create pink tape as an alternative of prosperity.

“Contemplating all federal laws, all sectors of the U.S. financial system and all agency sizes, federal laws price an estimated $12,800 per worker per 12 months in 2022 (in 2023 {dollars}). Small corporations with fewer than 50 staff incur regulatory prices of $14,700 per worker per 12 months – 20% larger than the associated fee per worker in massive corporations ($12,200),” in keeping with a 2023 study commissioned by the Nationwide Affiliation of Producers (NAM) as a continuation of earlier work by the authors for the U.S. Small Enterprise Administration’s Workplace of Advocacy.

That is dangerous sufficient. However in case you’re involved about home manufacturing, it’s best to know that the state of affairs is even harder for corporations that make issues: “The regulatory price drawback confronting small corporations is amplified drastically within the manufacturing sector, with small manufacturing corporations bearing greater than double the price of massive manufacturing corporations, or $50,100 versus $24,800 per worker.”

For all corporations, financial laws have been essentially the most burdensome—adopted by environmental laws, then tax compliance, and occupational security and well being and homeland safety (OSHHS) guidelines. For corporations with fewer than 50 staff, environmental laws had the best prices.

Within the manufacturing sector, environmental guidelines imposed the best expense for corporations of all sizes (over 80 p.c of the entire for corporations with fewer than 50 staff), adopted by financial guidelines, OSHHS, after which tax compliance.

“Federal and state necessities set up mandates for each factor of the manufacturing course of: the staff, equipment, strategies, inputs and waste,” according to a separate 2017 NAM report.

American corporations are strangling in pink tape imposed by American authorities. Unsurprisingly, small companies particularly say that heavy regulation is a killer.

Rising Regulatory Burdens Particularly Fear Small Companies

“The most recent Small Enterprise Index survey finds that 51% of small companies say navigating regulatory compliance necessities is negatively impacting their development,” the U.S. Chamber of Commerce revealed in December 2024. “Virtually as many (47%) say their enterprise spends an excessive amount of time fulfilling regulatory compliance necessities.”

The share of small companies saying they spend an excessive amount of time on regulatory compliance rises to 51 p.c of producers—and 57 p.c for skilled companies.

Sadly, this is not a brand new barrier to creating and rising profitable corporations. In 2018, Gallup found that amongst small companies, “extra homeowners point out points referring to authorities insurance policies and laws (24%) than some other” problem.

In 2011, “small-business homeowners in america are most definitely to say complying with authorities laws (22%) is a very powerful drawback going through them at this time,” also according to Gallup.

Given governments’ tendency to intrude ever extra deeply into human life and to search out new justifications for bureaucrats’ salaries, it needs to be no shock that regulatory prices rise 12 months after 12 months.

“Our analysis reveals that regulatory compliance prices of US companies have grown by about 1 p.c every year from 2002 to 2014 in actual phrases,” Francesco Trebbi, Miao Ben Zhang, and Michael Simkovic wrote in a 2024 Cato Institute analysis transient.

One p.c per 12 months in rising compliance prices might not sound like loads, however that compounds over time into an more and more extra oppressive tangle of pink tape that corporations should take care of. That hampers massive corporations, frustrates mid-size ones, and retains many small companies from ever getting off the bottom.

Shift Gears to Deregulation

Earlier than beginning a commerce conflict with the remainder of the planet, the Trump administration ought to strongly think about getting the U.S. authorities out of the way in which of American companies to allow them to construct, innovate, make use of, and compete with the international corporations that so fear U.S. politicians.

There are encouraging indicators the Trump administration is pleasant to that purpose. The primary Trump administration left workplace after “including a internet whole of $40.4 billion in regulatory prices,” which was lower than 10 p.c of the web burden imposed by the earlier Obama administration, according to the American Motion Discussion board. “When eradicating impartial companies, the Trump Administration really achieved internet regulatory financial savings of practically $1 billion over its time period.”

That’s, Trump not less than slowed the regulatory state and should have barely diminished its burden.

Final month, with Trump again in workplace, the Treasury Division dropped enforcement of burdensome “useful possession” reporting guidelines that have been inflicting confusion and concern for small companies.

“NFIB has been steadfast because the starting that this onerous requirement is a large intrusion into small companies’ privateness and creates an unprecedented new authorities database on Individuals,” responded Nationwide Federation of Impartial Enterprise President Brad Shut. “We agree with President Trump that necessities from the Company Transparency Act are ‘outrageous and invasive.'”

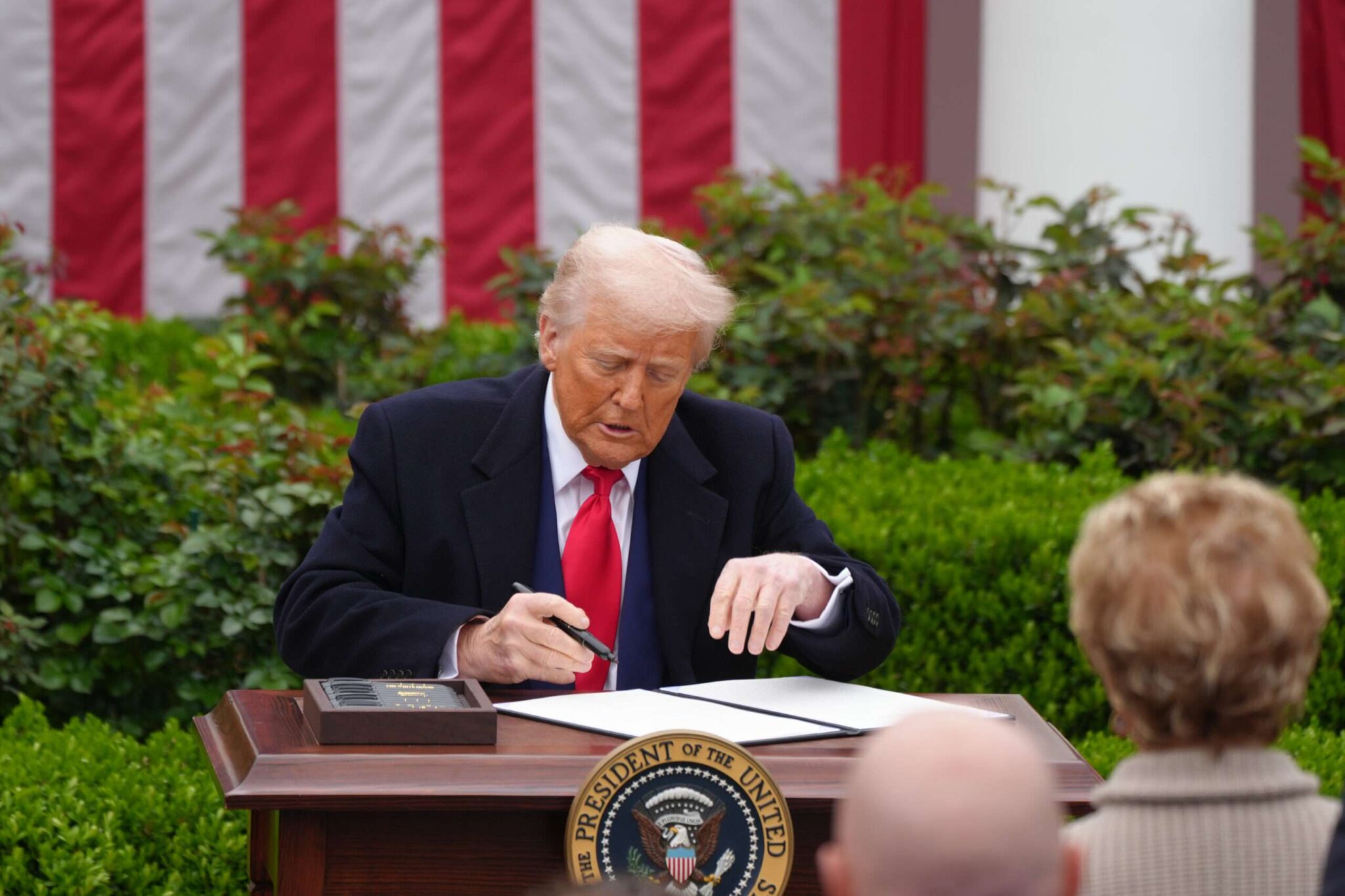

For his second time period, President Trump has signaled that deregulation is precedence. A January 31 executive order requires that “for every new regulation issued, not less than 10 prior laws be recognized for elimination” as a part of an effort “to considerably scale back the personal expenditures required to adjust to Federal laws.”

Deregulation is the place the Trump administration ought to focus its efforts, not tariffs. As soon as freed of regulatory deadweight, Individuals can be in a a lot better place to compete with the world.