Earlier this yr, dictionary.com added the word “greedflation” to its checklist of precise phrases, which it defines as, “an increase in costs, rents, or the like, that’s not resulting from market strain or every other issue natural to the financial system, however is attributable to company executives or boards of administrators, property homeowners, and many others., solely to extend income which are already wholesome or extreme.”

A nonprofit referred to as Groundwork Collaborative, with the mission of driving “coverage change with credibility, experience, and impression,” claimed credit for serving to push “greedflation” into the frequent political parlance. They is likely to be proper. The group authored a extensively cited study that purports to indicate how outsized company income have triggered rising costs. And the paper is simply as economically illiterate because the idea of “greedflation” at its core. The authors misrepresented and cherry-picked knowledge, and so they misunderstood the that means of a key financial indicator.

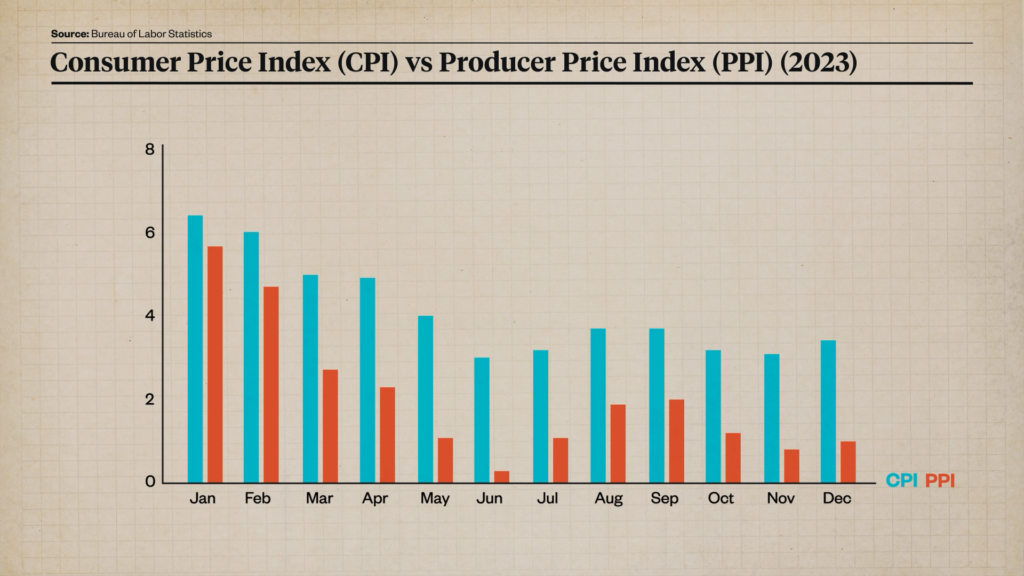

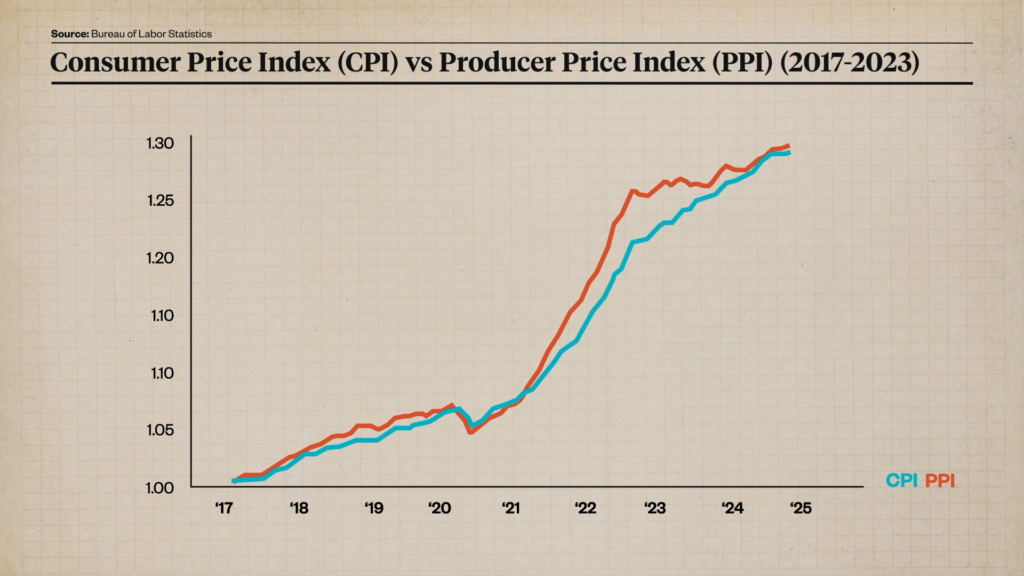

This research, which the Cato Institute’s Ryan Bourne has also written about critically, was co-authored by Liz Pancotti and Groundwork Collaborative’s Govt Director Lindsay Owens. They discovered that “costs for customers have risen by 3.4 p.c over the previous yr” whereas “enter prices for producers have risen by simply 1 p.c.” That is supposedly proof that companies are “exploiting their pricing energy” to drive up the price of items and companies.

With this chart, Owens and Pancotti introduced additional proof that corporations are spending much less and incomes extra. It exhibits that in 2023, the Client Worth Index persistently grew sooner than the Producer Worth Index. Owens and Pancotti interpret this to imply that for U.S. companies, the costs they charged outpaced their enter prices.

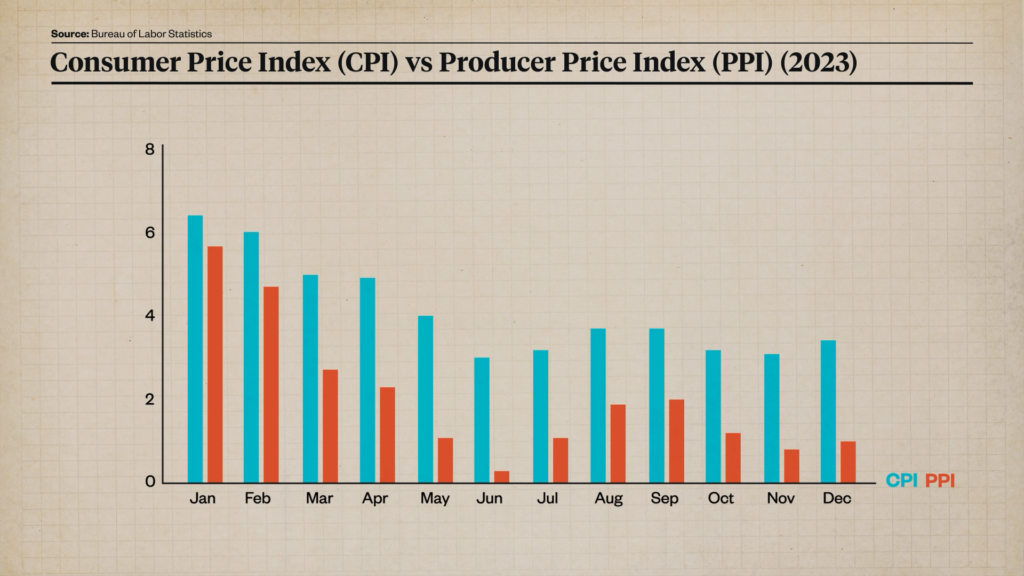

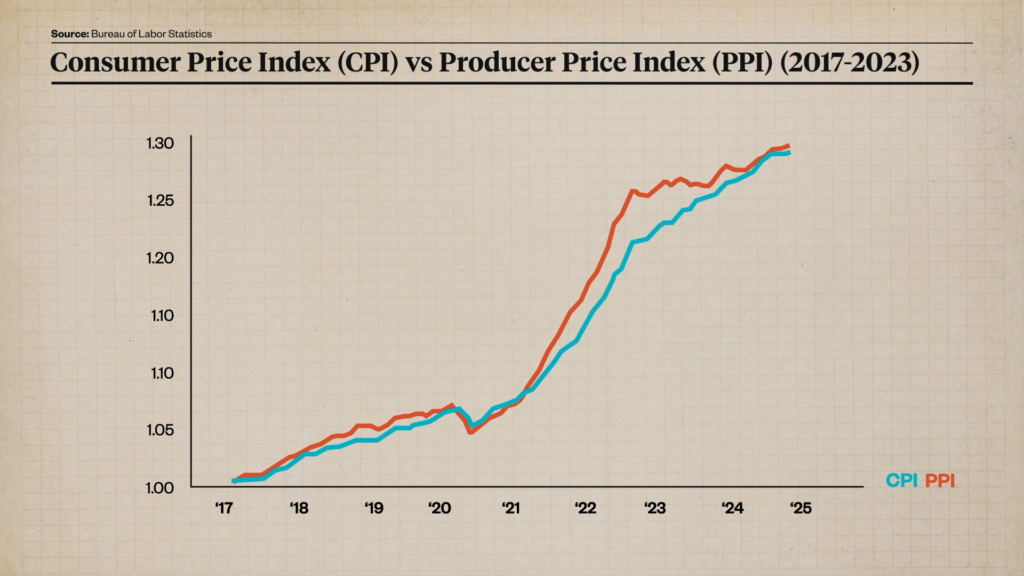

The primary drawback is that Owens and Pancotti cherry-picked a one-year timeframe to inform a deceptive story. Here is that very same knowledge within the type of a line graph.

Within the interval that they selected to focus on, the Client Worth Index was rising sooner. However should you pull again, you see that the prior yr the Producer Worth Index grew sooner. In 2023, the Client Worth Index was enjoying catch up. Now the 2 are roughly in sync.

Owens and Pancotti misrepresented the information by cherry-picking one yr, but it surely does not matter both approach for the purpose that they had been attempting to make. That is as a result of in addition they misunderstood the that means of the Producer Worth Index. It measures the costs at which producers promote their merchandise to wholesalers; it does not measure enter prices, or what corporations spend making their merchandise. It is a value index, not a value index. So evaluating it to the Client Worth Index tells us nothing about company revenue or “greedflation.”

Owens and Pancotti included extra proof to help their declare. They claimed “that company income drove 53 p.c of inflation throughout the second and third quarters of 2023.” By analogy, that implies that if the worth of a can of chili went up by a greenback, the corporate spent 47 cents of that additional revenue paying employees, elevating cows, tomatoes, beans, and so forth, leaving a whopping 53 cents in pure revenue—an instance of “greedflation.”

Once more, Owens and Pancotti cherry-picked a selected time interval to get a headline-grabbing consequence.

This chart exhibits the company revenue margin in blue—what for a can of chili could be the promoting value to the patron minus the price of the cows, the beans, the tomatoes, and many others., plus wages paid to employees—versus the worth that corporations are charging in orange. We are able to see that within the interval the authors have highlighted (proven in mild colours) costs barely budged.

Company income could have risen, but it surely’s a big share of a tiny quantity. By analogy, although company income accounted for 53 p.c of the elevated value of a can of chili, the worth solely went up by one thing like a penny. Meaning company income drove up the worth of chili by about half a cent. It did not have a lot impression on American wallets.

Should you take an extended view, you see time durations through which costs had been rising whereas income had been falling, just like the second quarter of 2021 to the primary quarter of 2022, and the third quarter of 2022 to the primary quarter of 2023, which the research authors did not point out. The most important value climb occurred previous to the second quarter of 2022 when income had been going up and down. Owens and Pancotti centered on the second and third quarters of 2023 as a result of they knew it could yield a headline-grabbing quantity.

However had been employees getting cheated?

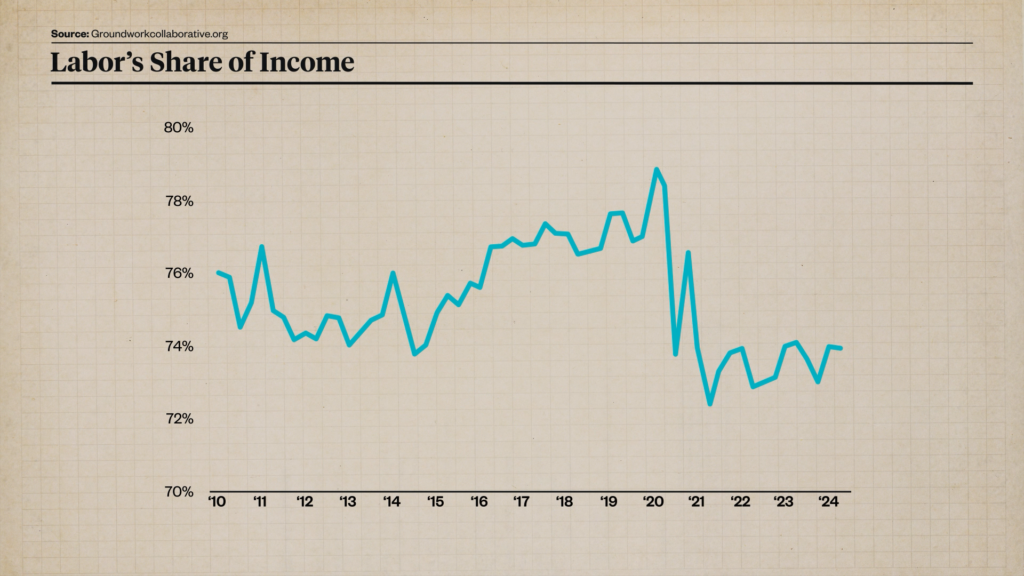

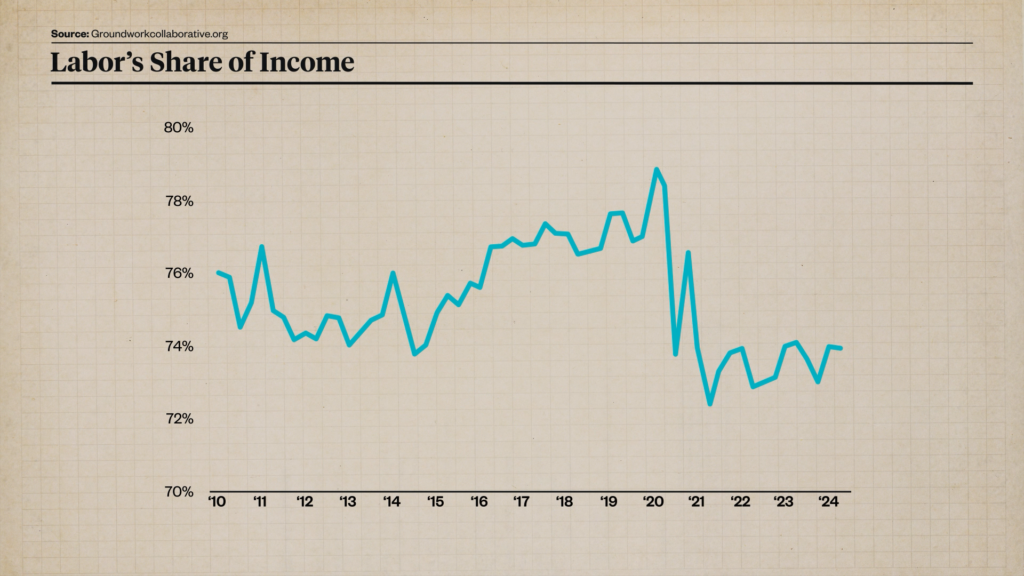

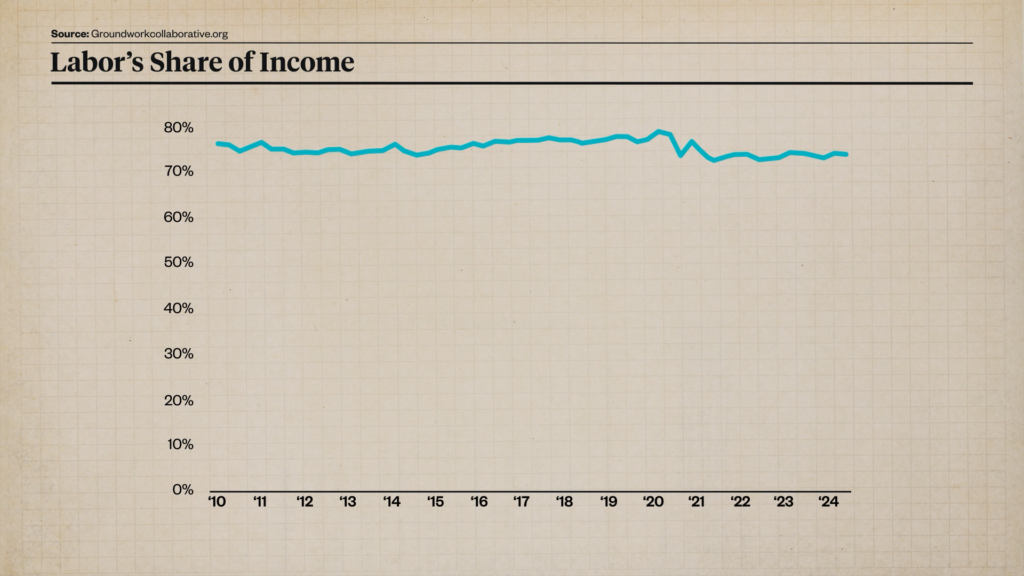

The research additionally claims that much less and fewer of what corporations earn goes to employees’ compensation, as illustrated by this chart, displaying a declining labor share of revenue beginning round 2020.

Once more, this can be a cherry-picked time interval. Right here is identical knowledge going again to the 2008 monetary disaster.

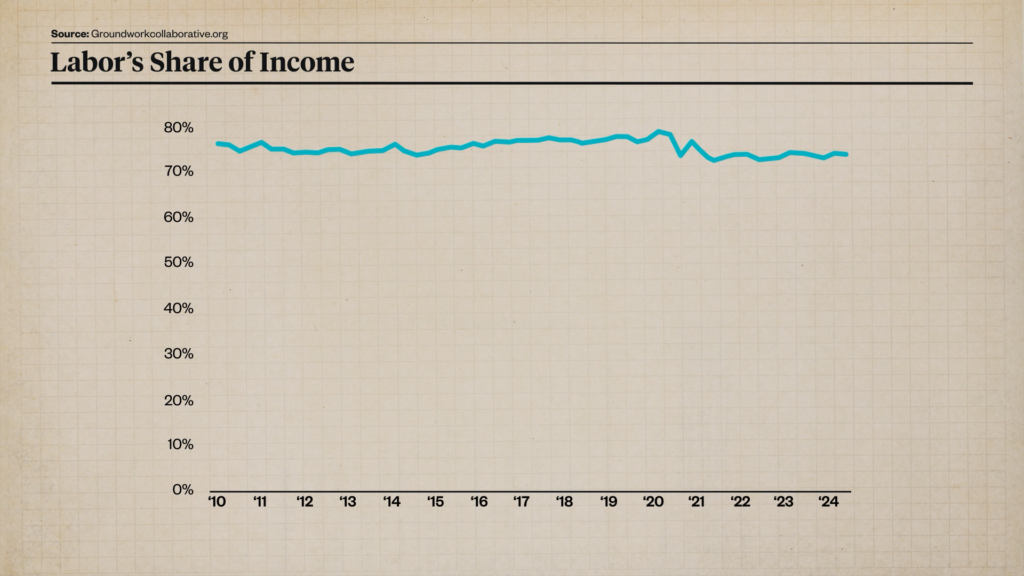

Owens and Pancotti additionally use a typical trick to magnify modifications. Their graph makes use of 70 p.c because the zero level on the Y-axis. Right here is identical graph with the proper zero level.

However there’s nonetheless a decline…so what occurred? COVID-19! Lockdowns and financial turbulence introduced a major drop in what employees had been incomes. However because the second quarter of 2020, lengthy earlier than inflation grew to become a significant drawback, labor’s share of earnings has held pretty regular. And it is hovering across the common of what it has been because the 2008 monetary disaster.

Sen. Bob Casey (D–Pa.), who’s an ally of Vice President Kamala Harris, has been notably outspoken about greedflation.

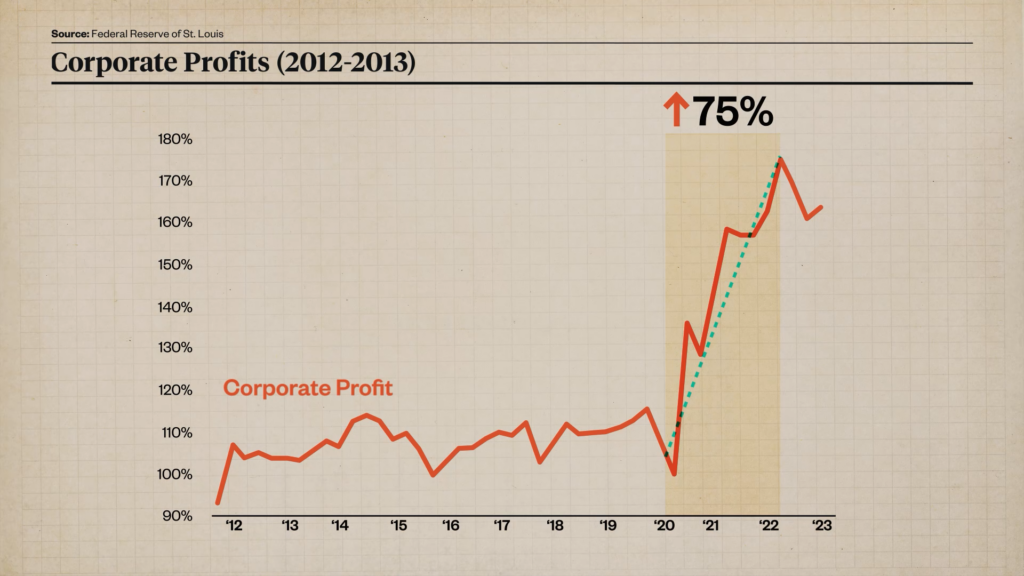

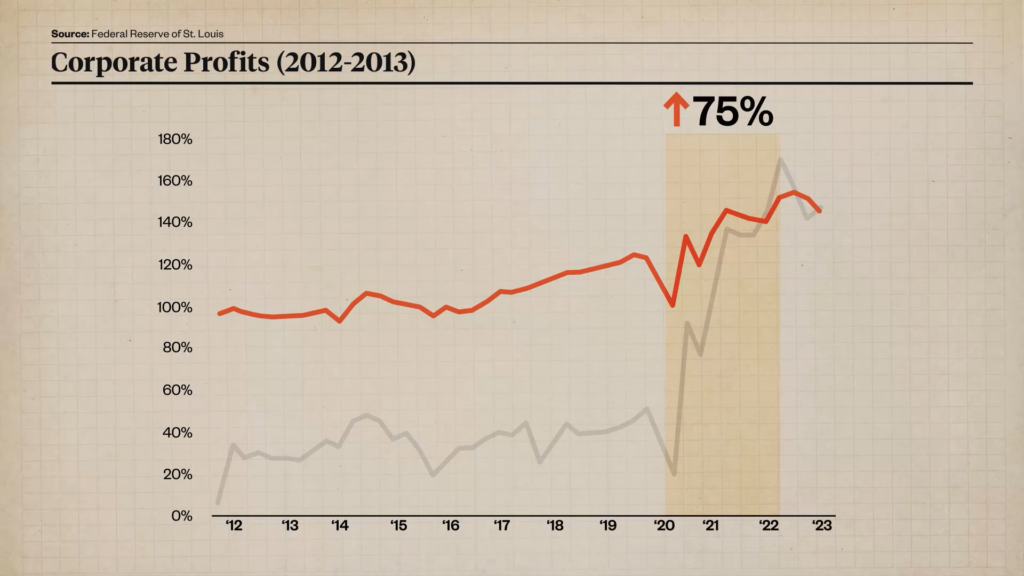

Casey revealed his personal flawed financial analysis on the subject, claiming in one report that “[f]rom July 2020 by means of July 2022, inflation rose by 14 p.c, however company income rose by 75 p.c, 5 instances as quick as inflation.”

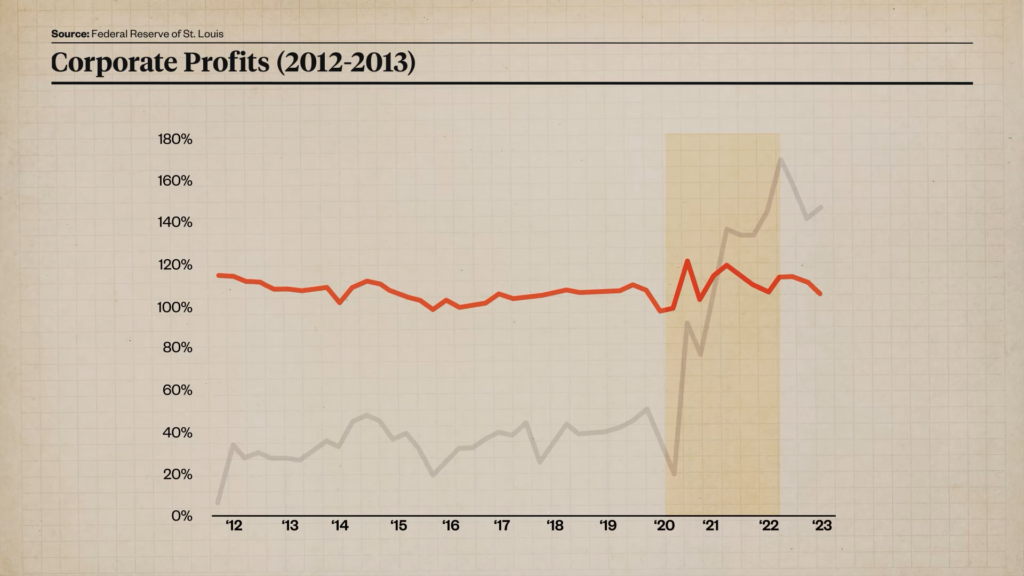

He sourced that declare to this chart from the Federal Reserve of St. Louis, which appears dramatic.

Casey makes use of the identical non-zero Y-Axis scale because the Groundwork Collaborative graph.

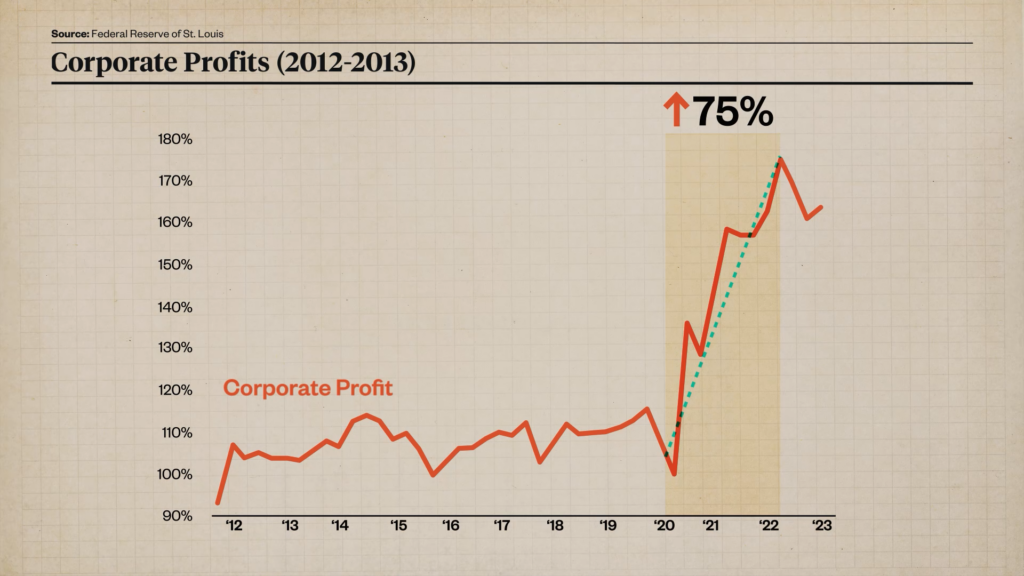

Here is the way it ought to look.

OK, but it surely nonetheless appears like company income shot up after 2020.

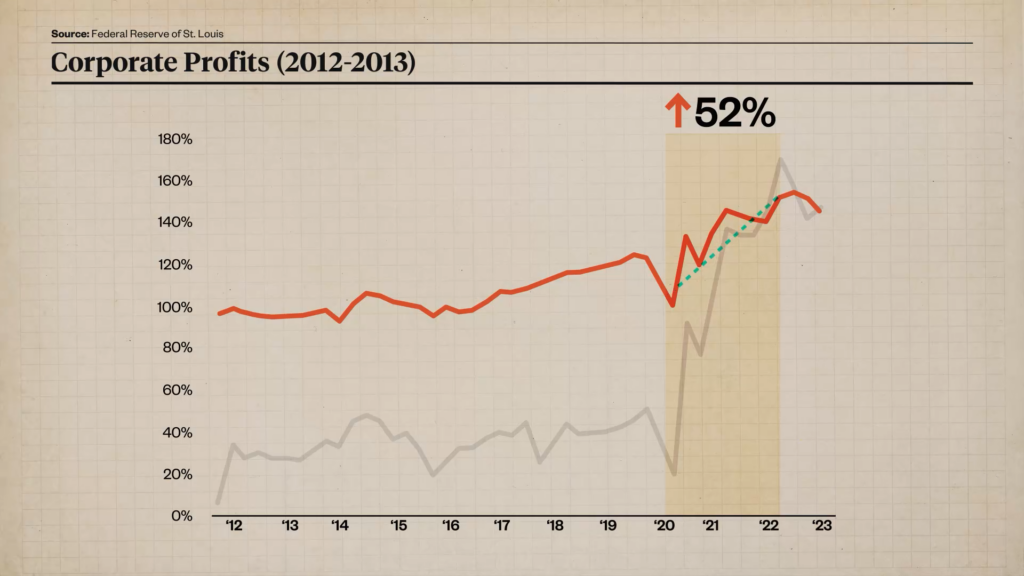

The issue is that Casey selected to make use of a distinct measure of company revenue than the U.S. Bureau of Financial Evaluation (BEA). In contrast to the BEA, he did not modify his top-line figures for what’s often called stock valuation and capital consumption changes, which distort the information should you do not right for them.

Take into account an organization that makes its product for $0.93 and sells it for $1.00, concerning the common revenue margin for U.S. companies. Now, 14 p.c inflation comes alongside and the promoting value goes as much as $1.14. Because the $0.93 prices have already been incurred, the paper revenue goes as much as $0.21, or from 7 p.c to 18.4 p.c. However the buying energy of the $1.14 the corporate will get is identical because the $1.00 it could have acquired had there been no inflation. Its actual income haven’t elevated however its company taxes in all probability will.

If we have a look at issues in financial phrases moderately than easy accounting, we now have to acknowledge that the worth of the stock went up 14 p.c from $0.93 to $1.06. The corporate spent $0.93 making it, however that was $0.93 in {dollars} with 14 p.c extra buying energy than present {dollars}. Furthermore, its capital investments in factories, vehicles, farmland, or different belongings had been additionally made in outdated, uninflated {dollars}, so the depreciation expense for these belongings ought to be elevated by 14 p.c for consistency. For this reason stock valuation and capital consumption changes are notably essential in instances of excessive inflation.

If we take these changes into consideration and use the BEA’s official numbers, this is how Casey’s chart appears:

Company income did not rise by 75 p.c throughout this two-year interval, as Casey claimed—however they did rise by 52 p.c, which nonetheless seems like so much.

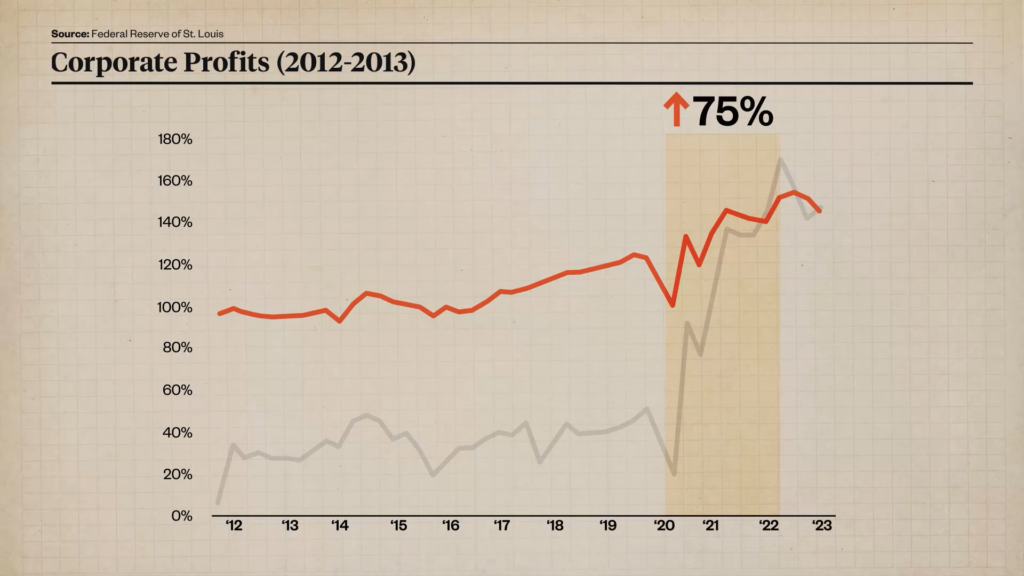

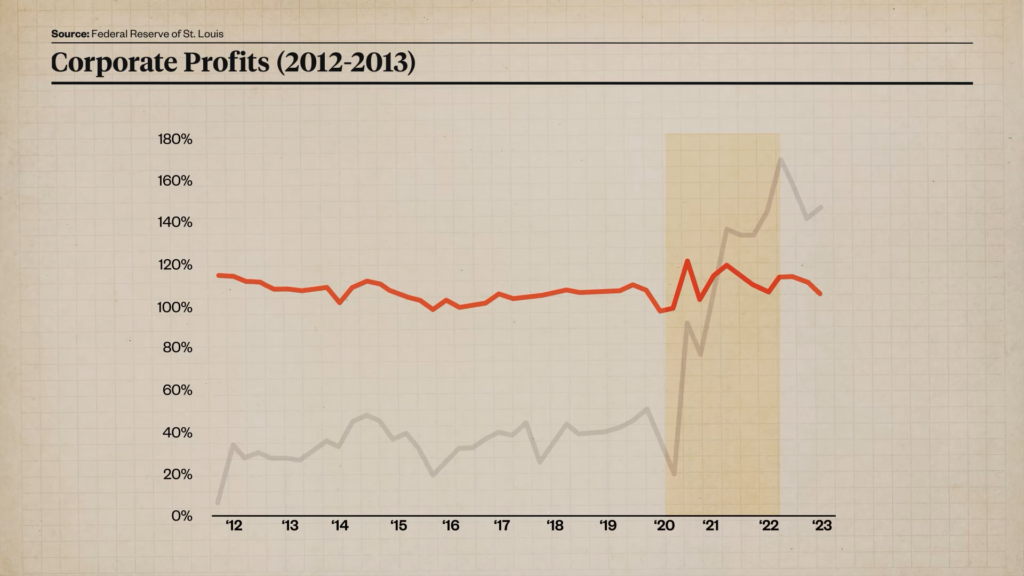

However now we will additionally see a distinct story within the knowledge: Company income have been rising since 2016, with a short interruption and a few volatility throughout the pandemic. They have been rising as a result of the U.S. financial system has been rising—companies offered extra items and companies, employees earned more cash, and the financial system was working sooner.

That is why it is smart to have a look at company income as a fraction of home revenue. If we make that adjustment, the graph appears like this:

Now a lot of the impact that Casey trumpeted has disappeared.

Politicians and activists declare that company income are inflicting inflation, however the true story is that inflation is creating principally fictitious accounting income and tax complications for companies. General, company income stay fairly steady as a share of home revenue.

Throughout his speech on the Democratic Nationwide Convent, Casey stated, “We’re preventing for honesty…will you battle for it?” Casey ought to check out his personal knowledge as a part of that battle. Greedflation could also be an efficient political speaking level, however there’s nothing trustworthy about it.

Photograph Credit: Tom Williams/CQ Roll Name/Newscom, Midjourney

Music Credit: “Liminal Area,” by Theatre of Delays by way of Artlist; “Blue Beings,” by Tamuz Dekel by way of Artlist; “Fragments,” by Tamuz Dekel by way of Artlist.

- Graphics Producer: Adani Samat

- Assistant Editor: César Báez

- Audio mixing: Ian Keyser

- Digital camera: Cody Huff

- Digital camera: Justin Zuckerman

- Graphic Design: Nathalie Walker

- Shade Correction: Cody Huff