President-elect Donald Trump has promised to impose enormous new tariffs on items imported into the USA, a tax improve that would price Individuals hundreds of billions of dollars yearly.

Except Congress acts quickly, Trump may have the ability to do all of it and not using a single vote by the nation’s elected representatives.

Opponents of Trump’s tariff plans—together with enterprise teams and commerce associations whose members could be hit with those higher costs—are eyeing the upcoming lame-duck session of Congress as presumably the final, greatest hope of yanking some tariff powers again from the chief govt. With a small Democratic majority within the Senate and President Joe Biden within the White Home till January, there may be at the very least a slim hope that lawmakers may restore among the steadiness of energy over commerce coverage.

“President-elect Trump’s aggressive tariff proposals, together with across-the-board tariff will increase on our closest allies, can have important financial and overseas coverage penalties, together with larger costs for customers and companies, potential commerce wars, and disruptions to provide chains,” Ed Brzytwa, vice chairman of worldwide commerce for the Client Expertise Affiliation (CTA), instructed Motive through electronic mail. Beforehand, the CTA estimated that Trump’s tariffs may add as a lot as 40 % to the sticker value for gaming consoles and in addition improve the value of things like smartphones, laptops, and televisions.

“To stop these outcomes, the Congress ought to instantly take into account and move the No Taxation With out Illustration Act,” Brzytwa wrote.

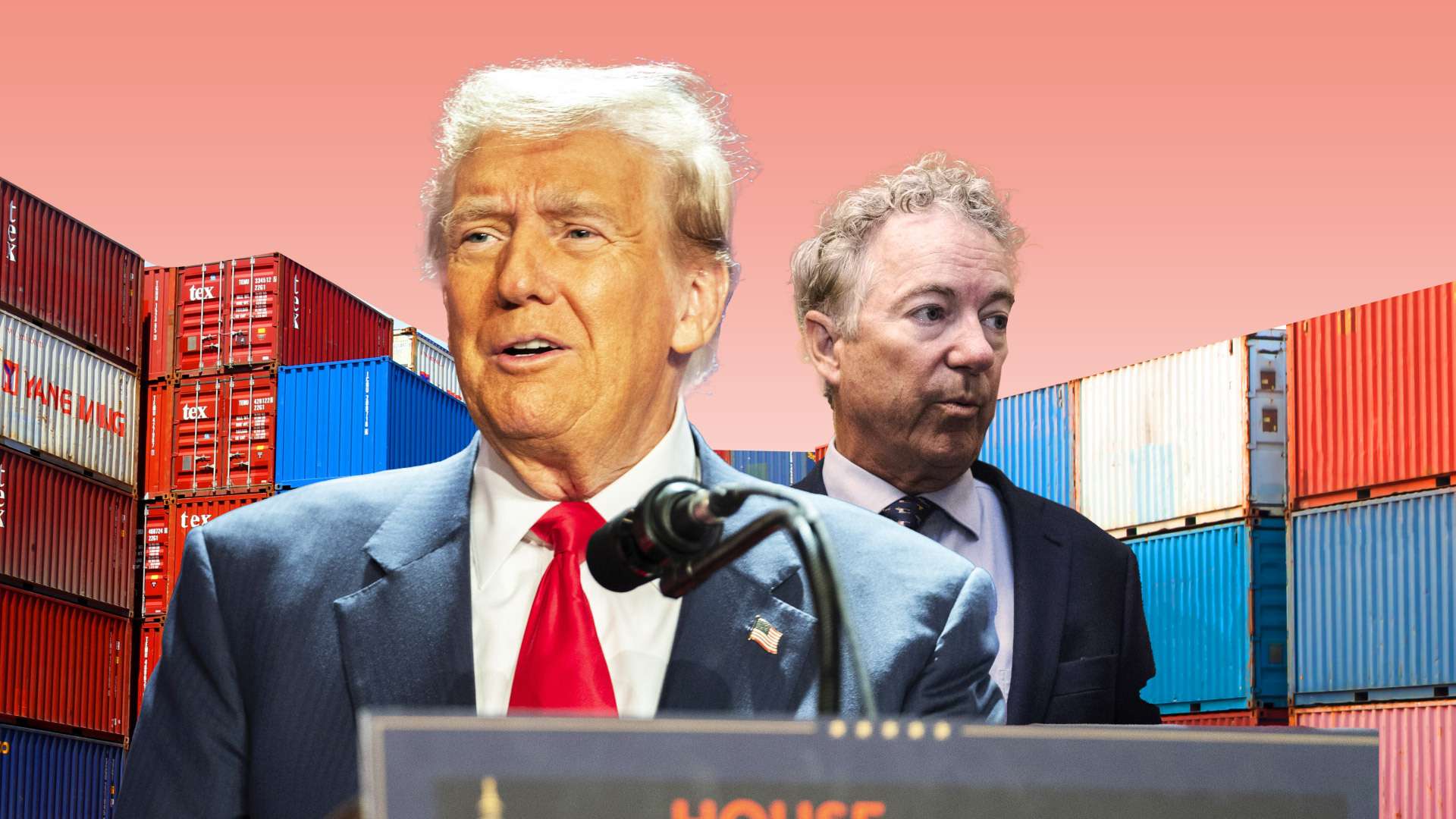

That bill, authored by Sen. Rand Paul (R–Ky.), would require congressional consent earlier than a president may impose new tariffs. When he launched the invoice in September, Paul mentioned it will restore “a core precept of American governance” by guaranteeing Congress authorized new taxes.

“Unchecked govt actions enacting tariffs tax our residents, threaten our economic system, elevate costs for on a regular basis items, and erode the system of checks and balances that our founders so rigorously crafted,” Paul mentioned in a statement.

Along with restoring a steadiness of energy over commerce coverage, advocates of the measure say it will promote financial stability by stopping abrupt swings in tariffs based mostly on the president’s whims.

Bryan Riley, director of the free commerce undertaking on the Nationwide Taxpayers Union Basis, a nonprofit that opposes tariffs, calls Paul’s proposal “crucial invoice” that Congress may take into account throughout the lame-duck session. It could appear unlikely that the Republican majority within the Home would embrace a proposal to restrict Trump’s commerce powers, however Riley argues that failing to take action could possibly be a shortsighted mistake.

“At present, 81 of the highest 100 agricultural-producing congressional districts are represented by Republicans,” he writes. “Many of those representatives have been working to move a farm invoice. The advantages of a brand new farm invoice are negligible in comparison with the potential price of a brand new commerce battle.”

Certainly, the prices of Trump’s commerce insurance policies fell immediately on American farmers throughout his first time period, as tariffs raised the value of farm tools and different obligatory items and retaliation from different international locations harm agricultural exports. Trump eased a few of that ache by having taxpayers bail out farmers, however lawmakers have inserted a provision into this yr’s farm invoice to prohibit another bailout.

If Congress doesn’t block Trump’s tariffs, there’s additionally an opportunity the courts may become involved. Jennifer Hillman, a professor at Georgetown Legislation Middle, tells NBC Information that it could possibly be “problematic” for Trump to impose sweeping tariffs on all imports with out congressional authorization as a result of many of the legal guidelines delegating these powers to the manager require extra particular actions tied to sure merchandise or imports from sure international locations.

Some current Supreme Court docket rulings that embraced the “main questions doctrine”—a constitutional regulation idea that claims Congress should explicitly authorize govt department actions on points which have huge “financial and political significance”—may be an element. That idea was on the heart of the Supreme Court docket’s choices that blocked Biden’s scholar mortgage forgiveness scheme and put an finish to Chevron deference. It may show to be a stumbling block for Trump’s tariffs too.

Nonetheless, it will be higher for Congress to take a proactive position somewhat than ready for the courts to intervene. The Structure and customary sense say that the manager department shouldn’t be in a position to impose an enormous tax improve on American customers and companies with out the consent of Congress. The following few weeks is perhaps the final likelihood to make sure that’s nonetheless true.