Buyers have been amassing wagers on Donald Trump’s return to the White Home for weeks, trimming holdings of long-term US bonds and shopping for Bitcoin, amongst different issues. Now, they’re contemplating whether or not Joe Biden’s exit from the race boosts the percentages of a Democrat victory — and the way a lot they need to recalibrate their bets.

One factor appears sure after the president dropped his reelection bid: Although the announcement was broadly anticipated because the 81-year-old confronted stress from allies, it injects a wild card into the marketing campaign that may seemingly translate into volatility for markets.

“This implies extra uncertainty,” stated Gene Munster, co-founder and managing accomplice at Deepwater Asset Administration. “There was numerous confidence about Trump profitable, and markets gained’t like this new uncertainty, together with the information cycle about who’s in, who’s out, and all these unknowns.”

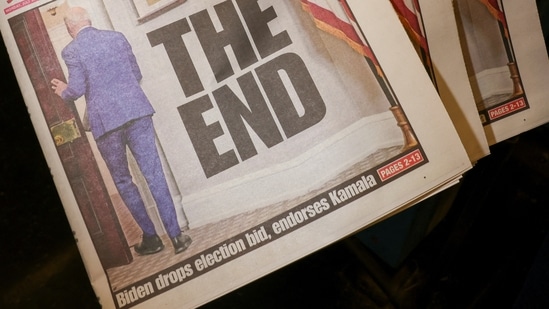

Biden’s announcement Sunday that he was ending his effort to hunt one other time period and endorsing Vice President Kamala Harris is the most recent of a number of political shocks absorbed by markets in latest weeks.

As traders digest the most recent information, the Trump commerce — favoring sectors and techniques seen as benefiting from the Republican’s advocacy of looser fiscal coverage, increased commerce tariffs and weaker laws — is more likely to face headwinds.

This, whereas traders are additionally bracing for potential market convulsions from the wave of second-quarter earnings outcomes which might be simply beginning to come via, and as they proceed to plot situations for when the Federal Reserve will start slicing rates of interest.

Buyers React

The greenback edged decrease in Asia buying and selling Monday, with the euro, Swiss franc and Mexican peso seeing marginal features. Treasury yields dipped throughout the curve, whereas US fairness futures had been modestly increased.

“The principle thought course of within the bond market needs to be what this new uncertainty brings. Individuals had gotten to the purpose the place they had been piling into the Trump commerce – with it starting to develop into an actual narrative. I had thought that was manner too quickly,” stated Glen Capelo, managing director at Mischler Monetary. “The curve steepening commerce will in all probability should unwind slightly bit.”

Markets could also be jumpy as merchants wait to see if Harris secures her get together’s nomination and gathers sufficient momentum to problem Trump’s lead within the polls. As merchants await new polls reflecting Biden’s absence, betting market Predict It has Harris as the favourite to develop into the Democratic nominee, however Trump nonetheless favored to win the presidency.

The fundamentals of the Trump commerce have taken the type of help for rising US bond yields, features in financial institution, well being and vitality shares in addition to Bitcoin and a stronger greenback — at the same time as Trump himself has signaled he prefers the US foreign money to weaken.

A few of the Trump commerce within the bond market had already began to subside final week, as traders turned their consideration again towards financial information and the Fed. In the meantime, latest strikes in shares have been marked by a shift out of Large Tech shares and into smaller corporations in sectors that had been laggards.

“Buyers ought to anticipate a spike in volatility,” Dave Mazza, chief government officer of Roundhill Monetary, stated earlier than Sunday’s announcement. “If Vice President Harris can mobilize shortly to provide Trump a fabric run, then we must always anticipate volatility to linger. Nevertheless, if Trump continues to tug forward within the polls and traders view his win as inevitable, then the Trump commerce will take over and volatility will decline.”

What Bloomberg’s strategists say…

“Except there’s a materials change to Trump’s possibilities, merchants will seemingly place for greenback weak spot as there might be extra verbal assaults towards weak foreign currency echange main into November. In the meantime, Treasuries could have a extra nuanced outlook. Curve steepening is more likely to lengthen amid considerations about bigger deficits, however inside a framework of falling yields because the Federal Reserve strikes towards its first rate of interest lower this 12 months.”

— Mark Cranfield, Markets Dwell strategist. See extra on MLIV.

There may be little historic information to make use of for a learn on how markets will react. The newest instance of a sitting president not looking for a second time period was Lyndon Johnson in 1968.

“We simply don’t have numerous priority for a state of affairs with a candidate who didn’t undergo the conventional main course of,” stated Julie Biel, portfolio supervisor and chief market strategist at Kayne Anderson Rudnick. “So we’re as soon as once more persevering with our very long-term love affair with unprecedented instances.”

Some traders in Asia, earlier than Biden stepped out of the race, noticed the Trump commerce truly benefiting from his departure, which may result in stress on every little thing from broad China inventory benchmarks to the shares of Korean battery makers within the area.

Asian shares fell Monday, with Taiwanese and Korean shares underperforming, although analysts stated the strikes had been largely all the way down to destructive sentiment towards the know-how sector.

One complicating issue for bets on Asian currencies has been Trump’s criticism of the present weak spot within the yen and the yuan, which may cap stress even when his victory is anticipated to broadly strengthen the greenback. The yen was modestly stronger in afternoon buying and selling in Tokyo.

“President Biden dropping out of the elections provides new uncertainties to the market,” stated Citigroup Inc.’s Johanna Chua. “The market will reassess not solely the distribution of the presidential race chances but in addition the implications on the congressional race outcomes.”