Democrats at the moment are defending elite universities like Harvard and Columbia from threats to their federal funding and tax-exempt standing for allegedly violating public coverage regardless of as soon as championing the identical authorized precedent now getting used towards them.

The left championed the 1983 Bob Jones College v. United States ruling, which upheld the IRS’ resolution to revoke tax advantages from a spiritual faculty that banned interracial relationship. On the time, Democrats agreed with the federal authorities’s argument that no establishment partaking in discrimination ought to obtain public funds, even on spiritual grounds.

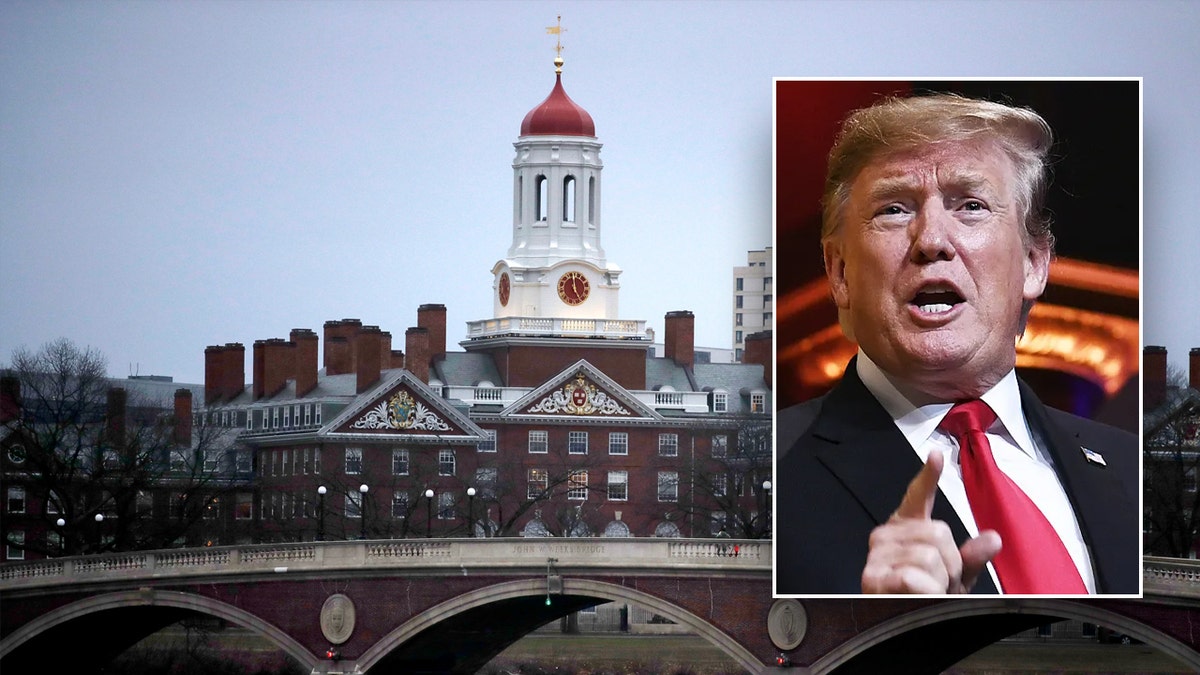

Now, because the Trump administration cites that very precedent in urging the IRS to revoke Harvard’s tax-exempt standing over claims the college is tolerating antisemitism and campus unrest, the left is accusing the administration of violating free speech legal guidelines to focus on ideological opponents.

‘SAFER WITHOUT HIM’: COLUMBIA STUDENT CLAIMS CLASSMATE ARRESTED BY ICE ‘HATES AMERICA’

Democrats are defending elite universities like Harvard and Columbia from threats to their federal funding and tax-exempt standing. (Reuters/Nicholas Pfosi)

“The Bob Jones case is a really robust precedent within the authorities’s nook on this,” Joe Bishop-Henchman, vp of tax coverage and litigation on the Nationwide Taxpayers Union Basis and an adjunct scholar on the Cato Institute, advised Fox Information Digital in an interview.

“The Bob Jones precedent makes it a tough case for Harvard to win. It might be so much simpler if that case wasn’t there, as a result of I feel they will should argue that they are being singled out, that that is politics,” he mentioned. “If the administration can argue that it is a violation of public coverage, then the Bob Jones precedent follows.”

At the moment, Bob Jones College, a Christian liberal arts faculty in Greenville, South Carolina, has a pupil physique of greater than 2,700. In 1983, it had insurance policies banning interracial relationship and marriage amongst college students and expelled college students who violated that coverage. The IRS mentioned that due to these racially discriminatory insurance policies, the varsity didn’t qualify for tax-exempt standing.

TRUMP ADMIN ASKS IRS TO REVOKE HARVARD’S TAX-EXEMPT STATUS

The Trump administration introduced it was freezing over $2 billion in grants and contracts after Harvard College mentioned it will not adjust to federal calls for relating to antisemitism. (AP Photographs)

The varsity argued that revoking its tax-exempt standing violated its spiritual freedom and that it was being punished for adhering to sincerely held beliefs. Nevertheless, the federal government countered that it shouldn’t subsidize organizations—via tax breaks—that defy established public coverage, notably legal guidelines towards racial discrimination.

The Supreme Court docket dominated 8 to 1 in favor of the federal authorities within the landmark Reagan-era case. The justices decided the IRS was allowed to disclaim tax-exempt standing to colleges that observe racial discrimination because it was towards public coverage. Regardless that the varsity claimed spiritual freedom, combating racial discrimination was a “compelling authorities curiosity.”

“That’s the letter of what Bob Jones mentioned, however possibly it should not simply be one college,” Henchman mentioned.

A drone view reveals anti-Israel protestors voluntarily packing up their encampment within the Yard at Harvard College in Cambridge, Massachusetts, on Might 14, 2024. (Reuters/Brian Snyder TPX IMAGES OF THE DAY)

The excessive court docket held that the establishments failed to supply the “useful and stabilizing influences in group life” required to obtain particular tax standing supported by taxpayers, in keeping with the judicial archive Oyez. Due to their bans on interracial relationships, the colleges couldn’t meet that normal.

The justices concluded that racial discrimination in schooling conflicted with a “basic nationwide public coverage.” Whereas acknowledging the colleges’ spiritual beliefs, the Court docket discovered that the federal government could restrict spiritual liberties when it’s essential to serve an “overriding governmental curiosity,” on this case, prohibiting racial discrimination. Because the court docket famous, “not all burdens on faith are unconstitutional.”

As such, the Trump administration argues that Harvard’s dealing with of antisemitism on campus ought to disqualify the college from protecting its 501(c)(3) tax-exempt standing. The IRS is predicted to make a ultimate resolution quickly, in keeping with a report from CNN, which first broke the story.