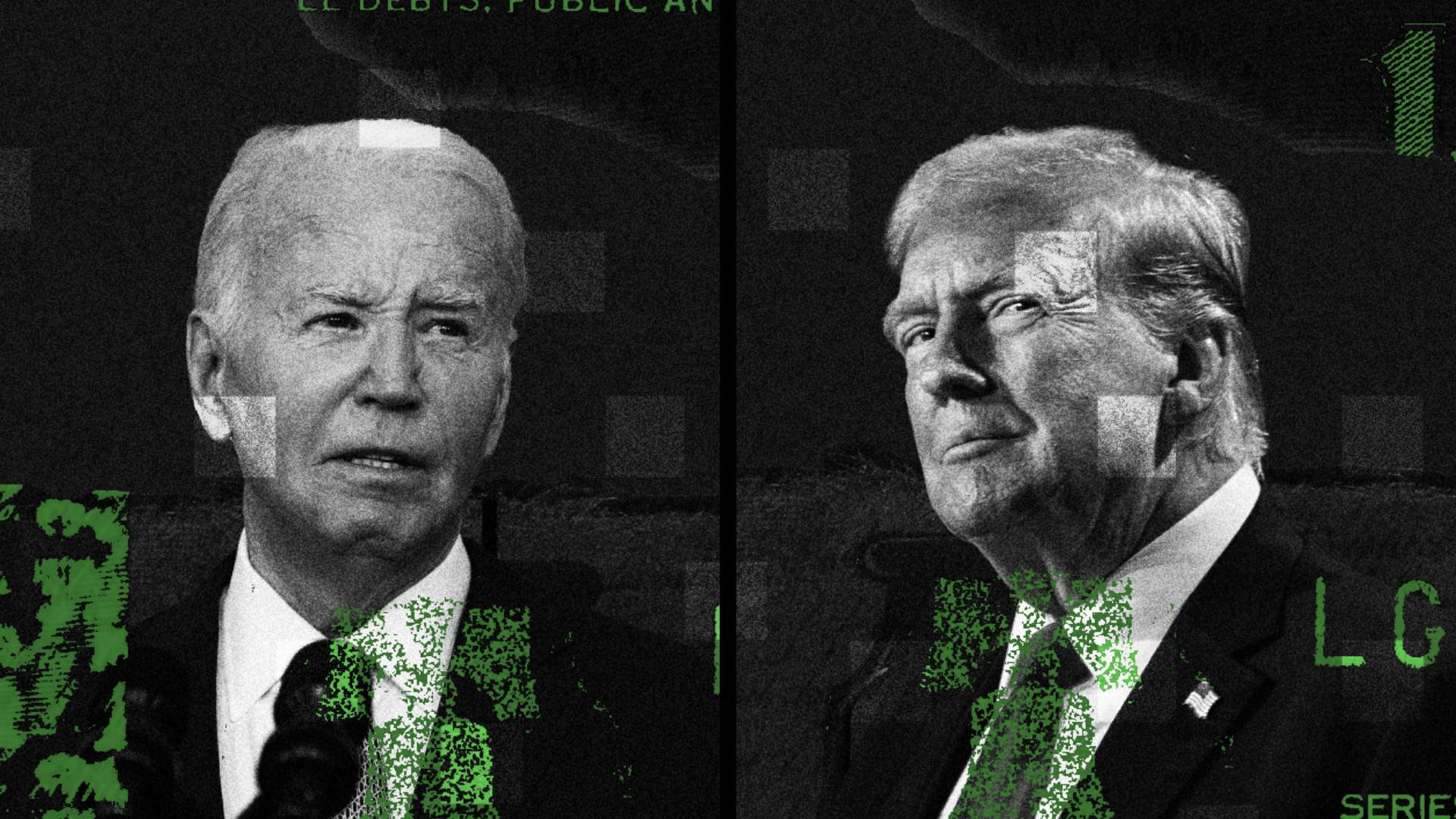

Throughout and after this week’s presidential debate, we should look past rhetoric and character to the core points shaping America’s future. Essentially the most urgent is the unsustainable progress of presidency spending and ballooning nationwide debt, which guarantees to rob People of wealth and dwelling requirements within the coming a long time. Make no mistake, it is a real disaster demanding fast consideration. Coping with it responsibly ought to be the litmus check for presidential management.

A latest Congressional Finances Workplace (CBO) report paints a dire image. Projected deficits have climbed alarmingly excessive, far exceeding earlier estimates. The federal funds deficit is now projected to succeed in $1.9 trillion in 2024, about equal to a staggering 6.7 % of annual gross home product (GDP). Extra troubling nonetheless is the exponential progress in authorities spending in comparison with projections from simply 4 years in the past.

Again in 2020, the CBO projected that federal outlays would attain $7.5 trillion by 2030. The most recent report places that quantity at $8.5 trillion—an extra $1 trillion in simply 4 years. The projected deficit for 2030 additionally elevated by roughly 25 %, or $450 billion, in these 4 years. In the meantime, projected debt accumulation grew by 20 %. In 2020, the CBO projected that the federal debt held by the general public would by 2030 attain $31.4 trillion. The most recent report now places that at $37.9 trillion. It is going to, nonetheless, develop one other $10 trillion by 2034, to $47.8 trillion!

Opposite to what you will have heard, this speedy growth of presidency is greater than a response to latest crises, although a few of it does replicate the outsized response to COVID-19. Extra importantly, the growth outcomes from a basic shift within the measurement and scope of federal actions.

Fiscal recklessness threatens the very foundations of our financial prosperity. As authorities expands, it crowds out personal funding, stifles innovation, and locations an ever-growing burden on future generations. The rising prices of debt service alone—projected to succeed in $1.7 trillion yearly by 2034—will devour an ever-larger share of our nationwide assets, leaving much less for vital investments in infrastructure, schooling, and analysis. The prices of those curiosity funds, in flip, will probably be paid for by extra borrowing. That can gasoline inflation and make the Fed’s job more durable.

These are a number of the reason why rising debt will increase our vulnerability to financial shocks and geopolitical crises. It reduces our fiscal flexibility to reply to future recessions or nationwide emergencies and probably undermines the greenback’s standing because the world’s reserve forex.

The candidate who actually grasps the gravity of this example and proposes concrete, life like steps to deal with it is going to exhibit the management our nation now desperately wants. A critical president should decide to speaking about this problem by inspecting each federal program and company, eliminating redundancies, and devolving acceptable obligations to state and native ranges. Extra importantly, we’d like an intensive assessment of entitlement applications.

Latest numbers from the Manhattan Institute’s Brian Riedl present issues are on observe to get a lot worse over the following 30 years, with gathered deficits of $115 trillion, together with Social Safety and Medicare deficits of $124 trillion (the remainder of the funds will produce a surplus of $9 trillion). Mainly, Social Safety and Medicare are the issue, and no candidate ought to be taken critically if he continues to assert his administration will not contact the applications, like each President Joe Biden and former President Donald Trump have completed.

For long-term financial stability, we should have a reputable plan to steadily scale back our debt-to-GDP ratio. This could embrace setting particular targets for deficit discount over the following decade, implementing computerized spending reforms if fiscal targets should not met, and reforming the budget-making course of. Whereas indirectly a fiscal measure, decreasing the regulatory burden on companies can spur financial progress and not directly enhance our fiscal place by rising tax revenues with out elevating tax charges.

As voters, we should demand that each candidates handle these points head-on through the marketing campaign season. Obscure guarantees and populist rhetoric are inadequate. We want detailed, actionable plans to place America on a sustainable fiscal path. The candidate who rises to this problem—who has the braveness to talk truthfully in regards to the powerful decisions forward and the imaginative and prescient to chart a course towards fiscal sanity—will show himself worthy of main our nation.

In these turbulent occasions, solely by reining within the leviathan of presidency can we safe prosperity and liberty for future generations. The stakes could not be increased. Let’s choose the candidates not by their charisma or their assaults on one another however by their dedication to doing what have to be completed. The way forward for our republic is dependent upon it.

COPYRIGHT 2024 CREATORS.COM