There is a bizarre little bus cease on the nook of 18th and Okay streets in Washington, D.C. On the within, a ticker tallies the nationwide debt in actual time, the glowing numbers whizzing by too shortly for the bare eye. On the surface, there is a printed poster with a spherical quantity for the overall debt: $34 trillion at press time.

I’ve lived in D.C. lengthy sufficient to recollect when altering that poster was an important day. However recently I have been checking repeatedly on my commute, for the reason that trillions are racking up extra shortly than they used to. The ink is barely dry on the present poster, but the oldsters on the Peter G. Peterson Basis, the fiscal duty nonprofit that maintains the show on the bus cease, will likely be on account of roll out $35 trillion fairly quickly.

The bus cease is a semidesperate try and persuade Washingtonians to care about—or a minimum of give a passing thought to—the nationwide debt as we go about our enterprise. The debt has grow to be an alarm bell ringing within the distance that individuals are pretending to not hear, particularly within the metropolis that precipitated the issue.

As Brian Riedl explains on this month’s cowl story, the one manner out will likely be if politicians—and voters—cease mendacity to themselves about the potential of a fast repair. We will now not “tweak our manner out of this,” he writes, as we would have within the Nineteen Eighties or ’90s. Nobody celebration’s pet proposals can resolve the disaster. But the bipartisan development is headed in precisely the flawed course. Politicians of each events have tacitly agreed to rule out all the viable options.

Maya MacGuineas, president of the Committee for a Accountable Federal Funds, commented on a current Congressional Funds Workplace report: “There is no such thing as a manner to have a look at these eye-popping numbers with out realizing we have to make a change. And but we now have lawmakers promising what they will not do: I will not increase taxes, I will not repair Social Safety, I will not pay for all of the issues I do need to do. And so we proceed on this harmful path.”

***

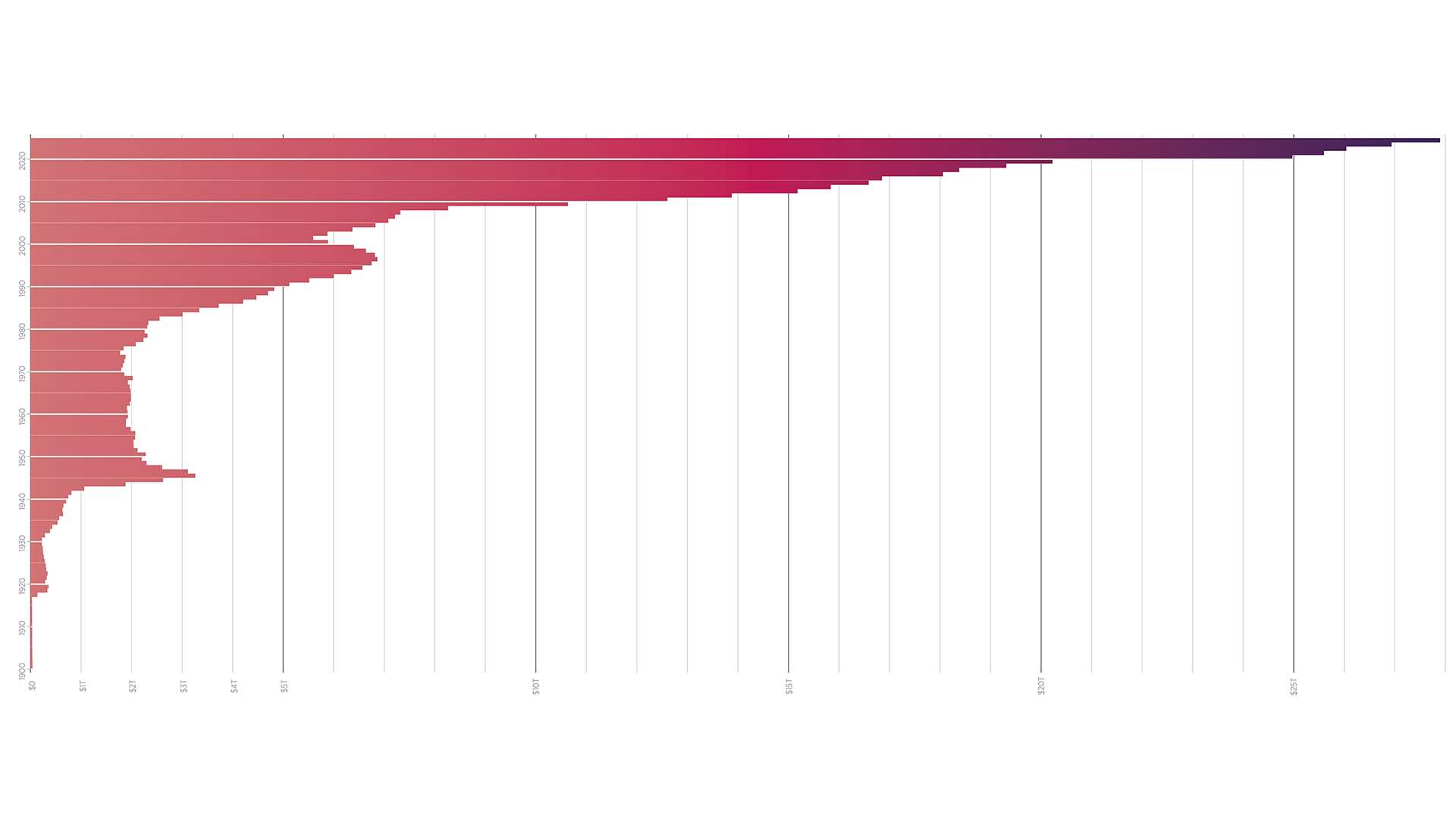

There are alternative ways to tally the debt: The Peter G. Peterson clock makes use of debt held by the general public plus debt held by federal belief funds and different authorities accounts, however Purpose‘s charts do not embrace the belief funds since that cash is not actually borrowed from anybody. The uncooked greenback figures for the gross federal debt is essentially the most surprising—and I actually do not begrudge the bus cease some shock worth—however economists are likely to agree that the debt as a proportion of gross home product is the extra significant illustration. So we have provided readers each on this particular version of Purpose. Be at liberty to unfurl this subject of the journal whichever manner you like at your personal bus cease, subway station, or espresso store to do some consciousness elevating of your personal.

President Joe Biden’s administration lately unveiled a price range plan that proposes borrowing a further $16 trillion over the following decade. Its backers declare this strategy is fiscally accountable, however the plan entails spending $86.6 trillion whereas gathering solely $70 trillion in revenues, resulting in annual deficits averaging practically $2 trillion. The administration touts a $3 trillion discount in projected deficits, however the plan slows the debt improve slightly than decreasing it. These figures additionally assume there aren’t any extra main crises, pure or man-made.

The answer to the nationwide debt lies in reevaluating and chopping again on pointless and wasteful packages, reforming entitlement packages comparable to Social Safety and Medicare, and implementing a extra environment friendly tax system that encourages financial development.

However none of this may even start to occur till politicians understand a requirement for it from the American folks. Rising debt reduces funding and might gradual financial development, whereas rising worries about inflation and the power of the U.S. greenback. It reduces confidence within the social security web and will increase the chance of a fiscal disaster. Maybe when these issues manifest, the voters will demand that politicians take the problem significantly. However by then, it could be too late for the financial stability and development we now have taken without any consideration.

Within the bus cease on Okay Avenue today, there’s normally a bundle of soiled baggage and rucksacks under the debt clock. In unhealthy climate, somebody is usually stretched out attempting to sleep underneath the shelter. Maybe Washingtonians strolling by can heed that extra human warning in regards to the self-inflicted prices of financial disaster, even when we now have grow to be numb to the numbers.