Through the COVID-19 pandemic, the federal deficit surged to unprecedented, barely fathomable ranges: greater than $3.1 trillion in 2020 and $2.7 trillion in 2021.

The federal deficit will quickly strategy these enormous figures as soon as extra—not attributable to one-time emergency spending in response to a disaster, however merely the results of the federal government’s routine operation.

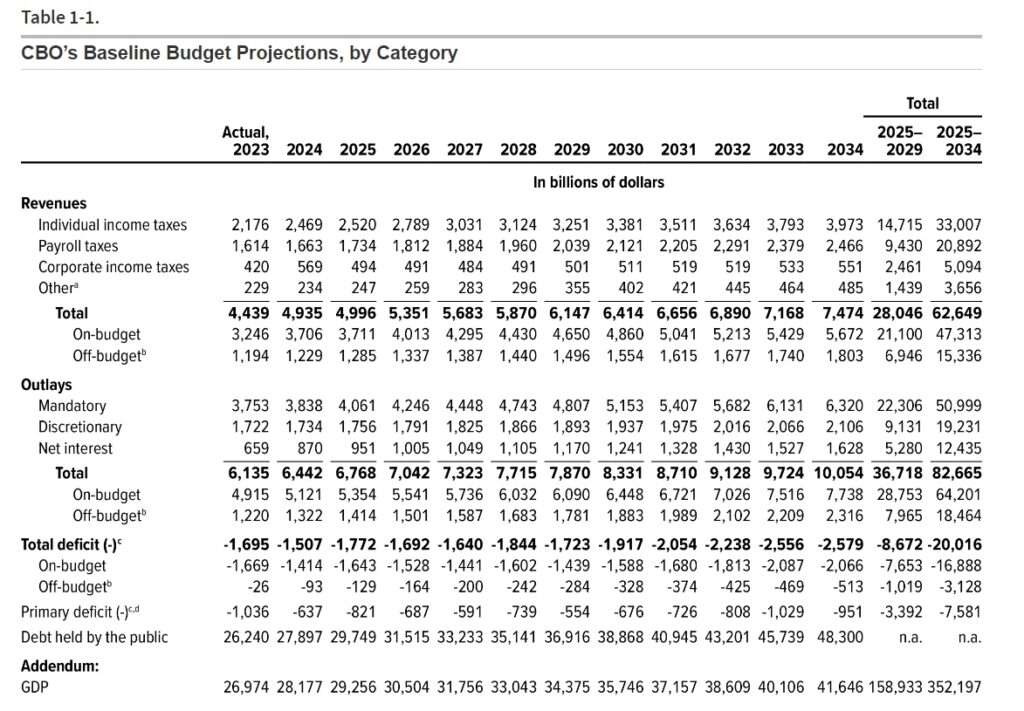

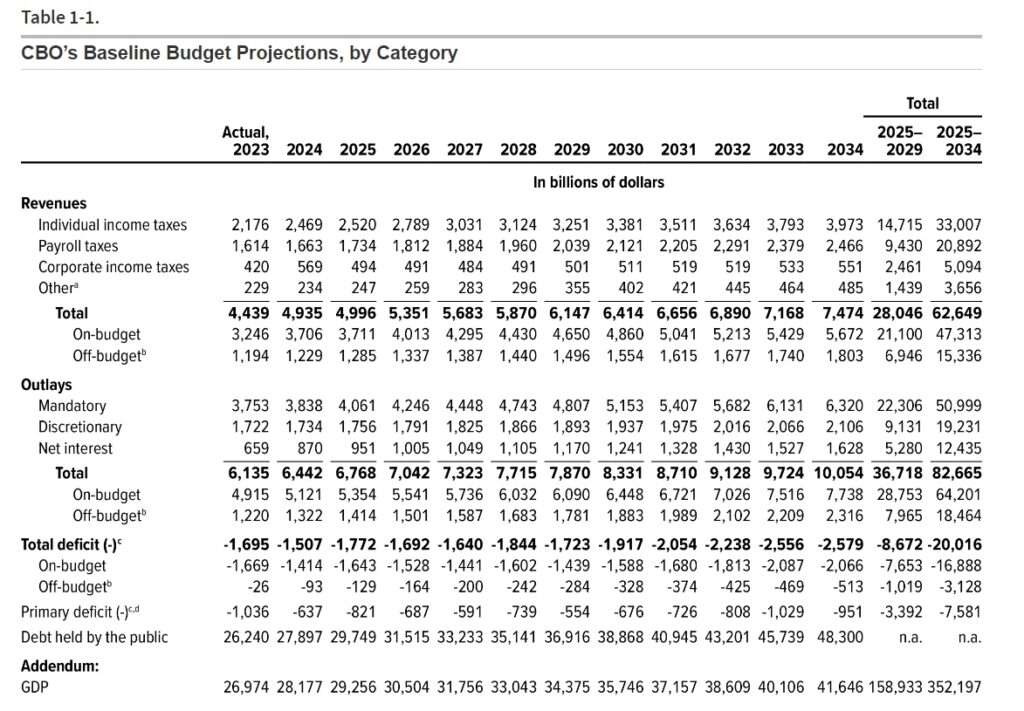

In a new semi-annual forecast launched Wednesday, the Congressional Finances Workplace (CBO) projected that the federal authorities’s annual finances deficit will exceed $2.5 trillion by 2034 if present insurance policies stay in place (and assuming no additional emergency spending of any sort, which looks as if a stretch). The federal authorities is on tempo to borrow greater than $20 trillion over the subsequent 10 years, the CBO estimates.

Listed below are three key issues to know concerning the new CBO report. First, it demonstrates how an excessive amount of borrowing prior to now will have an effect on the longer term.

An enormous issue driving deficits over the subsequent decade will probably be rising curiosity funds on the $34 trillion (and quickly rising) nationwide debt. As not too long ago as 2021, curiosity prices on the debt totaled about $350 billion, however that line merchandise is now rising due to greater rates of interest. The CBO expects curiosity prices to complete $860 billion this yr—exceeding army spending—and to succeed in $1.6 trillion by 2034. At that time, greater than 1 / 4 of all federal tax income will probably be directed towards paying the curiosity on the debt.

“That is 3 months of your federal taxes annually that won’t fund a single veteran, Social Safety profit, or freeway enlargement,” Brian Riedl, a senior fellow on the conservative Manhattan Institute and a former Senate finances staffer, wrote on X (previously Twitter). “What a waste.”

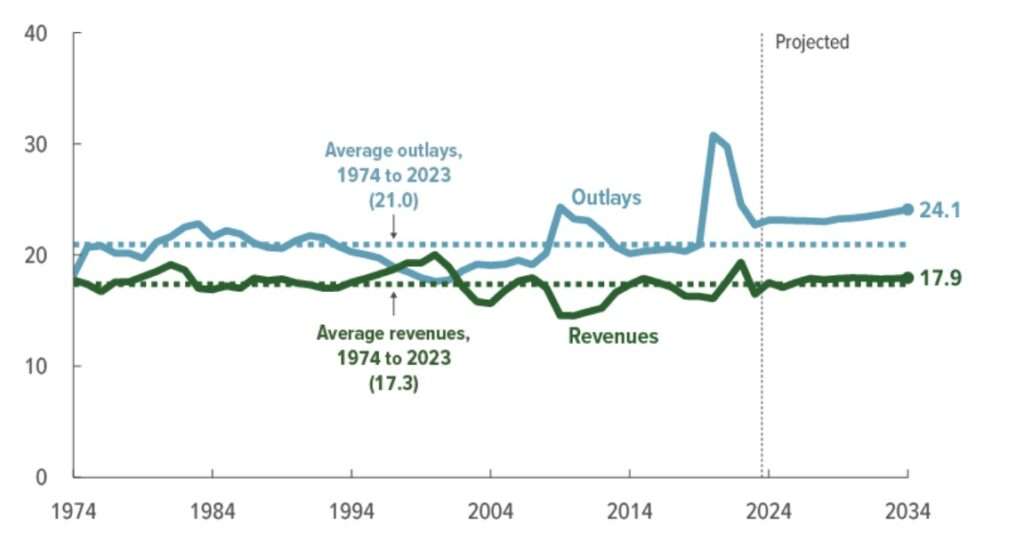

Second, the CBO projections clarify that the federal authorities has a spending downside, not a income downside.

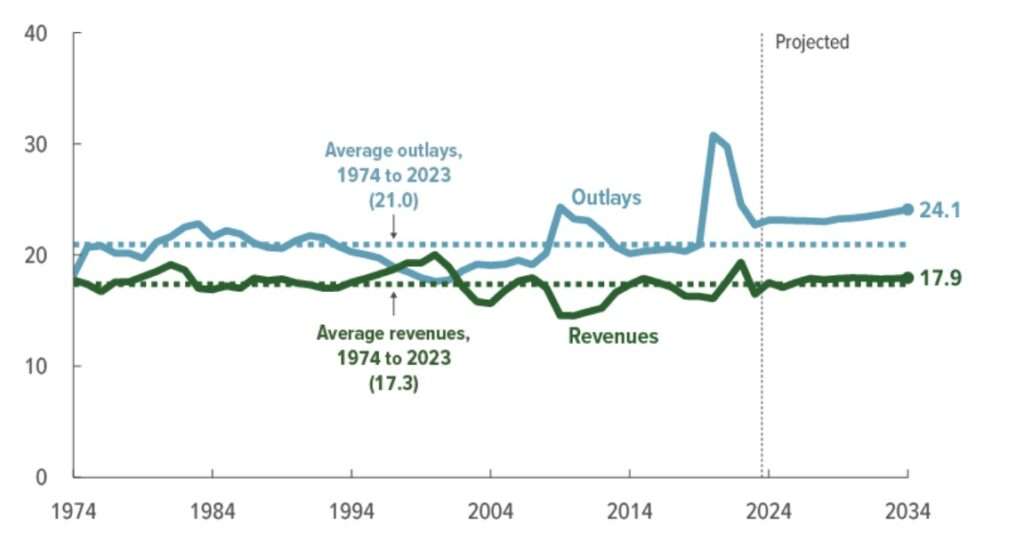

A finances deficit is the hole between how a lot the federal government collects in tax income and the way a lot it spends throughout a single yr. When deficits are anticipated to develop over a interval of years, which means spending is rising quicker than anticipated income, or income is falling relative to deliberate spending, or each. Within the federal finances, it’s clearly the previous.

Measured as a share of the economic system as an entire, federal tax income has traditionally averaged about 17.3 p.c. This yr, the CBO expects about 17.5 p.c of America’s gross home product (GDP) to be vacuumed up by the federal authorities, and over the subsequent 10 years tax collections will common about 17.8 p.c of GDP. That is barely above common, however the issue is that federal spending is anticipated to develop a lot quicker—and into territory nicely exterior of historic norms.

Lastly, we should always do not forget that the precise fiscal state of affairs is more likely to be worse than what the CBO is projecting—regardless of what the White Home is saying.

The Biden administration greeted the CBO’s new projections as an encouraging signal, pointing out that the estimates present a barely decrease deficit for this yr than the CBO had beforehand anticipated.

However you will need to take into account that the CBO’s projections look solely at present insurance policies and due to this fact assume that, amongst different issues, the Trump tax cuts is not going to be prolonged past their deliberate expiration in 2025. It additionally doesn’t account for the potential of one other main emergency, or perhaps a comparatively delicate recession. “The first deficits in CBO’s projections are particularly massive given the comparatively low unemployment charges that the company is forecasting,” the CBO notes.

As Riedl highlighted on X, a extra real looking various situation by which the tax cuts are prolonged and discretionary spending caps are usually not maintained ends in deficits that can exceed $3 trillion by 2030.

In brief: These pandemic-era deficits will not seem like outliers for very lengthy.