President Donald Trump’s election promise to carry down the price of dwelling took a bruising Wednesday as figures confirmed that U.S. inflation surged final month.

The patron worth index elevated 3% in January from a 12 months in the past, in line with the report from the Labor Division, which confirmed a rise of two.9% within the earlier month. It has risen from a three-and-a-half-year low of 2.4% in September.

The price of groceries, fuel, and used automobiles rose ― with the price of eggs spiraling.

With farmers hit by the avian flu epidemic, egg costs leaped by 15.2%, the largest month-to-month enhance since June 2015. Egg costs are up 53% from final 12 months.

The unexpectedly scorching inflation figures blow a gap in one in all Trump’s greatest pledges on the marketing campaign path.

“We’ll finish inflation and make America inexpensive once more, and we’re going to get the costs down. We have now to get them down,” he stated at a rally in September. “It’s an excessive amount of. Groceries, automobiles, the whole lot. We’re going to get the costs down.”

But shortly after the election, Trump began to reduce his ambitions.

“It’s laborious to carry issues down as soon as they’re up,” he stated in a November interview with Time. “You understand, it’s very laborious.”

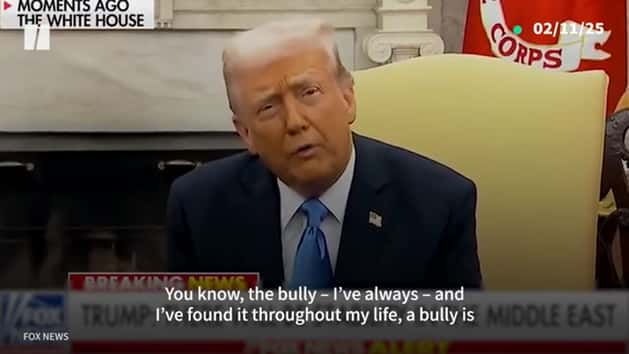

Quickly after the figures have been launched, Trump went into blame mode. He instructed that former President Joe Biden was the explanation for the spike, not his personal financial insurance policies, which economists have warned danger pushing prices greater.

“BIDEN INFLATION UP!” he wrote on Fact Social.

The newest inflation figures imply an imminent rate of interest minimize by the Federal Reserve is unlikely.

Earlier Wednesday, Trump known as for charges to come back down, claiming cheaper cash would “go hand in hand” along with his tariffs agenda.

“Curiosity Charges needs to be lowered, one thing which might go hand in hand with upcoming Tariffs!!!” he wrote. “Lets Rock and Roll, America!!!”

The Federal Reserve ignored Trump’s earlier demand to chop charges, holding the benchmark price for 2 weeks.