President-elect Donald Trump’s requires increased taxes on imports is already triggering discussions within the halls of Congress and the company board rooms of America.

Trump’s transition staff has reportedly had discussions with Rep. Jason Smith (R–Mo.), chairman of the Home Methods and Means Committee, about together with tariffs in a significant tax package deal that Congress will likely be engaged on subsequent yr—as a result of scheduled expiration of some of the 2017 tax cuts. Politico reports that these discussions are centered round utilizing tariffs as offsets for different tax cuts that Republicans want to go, although it’s unclear if the Home’s guidelines enable for that trade-off to be made.

However, hey, no less than it is an acknowledgement that tariffs are taxes!

Discovering methods to boost income that would offset the extension of the 2017 tax cuts isn’t just prudent fiscal coverage when the federal authorities is operating deficits of close to $2 trillion yearly. It is also in all probability mandatory if Republicans wish to go any main tax invoice via the Senate while not having 60 votes—because of the specifics of the reconciliation process, which permits some points to by-pass the filibuster so long as they’re judged to be revenue-neutral.

On the marketing campaign path, Trump repeatedly promised to make use of tariffs to offset a bunch of various tax modifications, together with his plans to exempt tipped revenue and Social Safety transfers from revenue tax. He additionally floated the thought of utilizing tariffs to totally exchange the revenue tax, which is laughably impossible.

Nonetheless, the indicators point out that Congress is taking Trump’s tariff-hiking plans significantly, and so too are American companies. The Washington Publish reported final month that some corporations had been already bracing for worth hikes that would come if Trump received the election. “We’re set to boost costs,” Timothy Boyle, CEO of Columbia Sportswear, told the Publish. “We’re shopping for stuff as we speak for supply subsequent fall. So we’re simply going to cope with it and we’ll simply increase the costs.”

In the meantime, The New York Occasions reported Friday that some clothes and shoe retailers are speeding to refill on imports earlier than January, when Trump might use his government authority to unilaterally impose increased tariffs.

Whether or not handed via Congress or enacted with the stroke of a presidential pen, increased tariffs will finally fall on American customers. A new report this week by the Nationwide Retail Federation, a commerce affiliation that represents grocers, shops, and on-line sellers, estimates that Trump’s proposed tariffs would “cut back American customers’ spending energy by $46 billion to $78 billion yearly the tariffs are in place.”

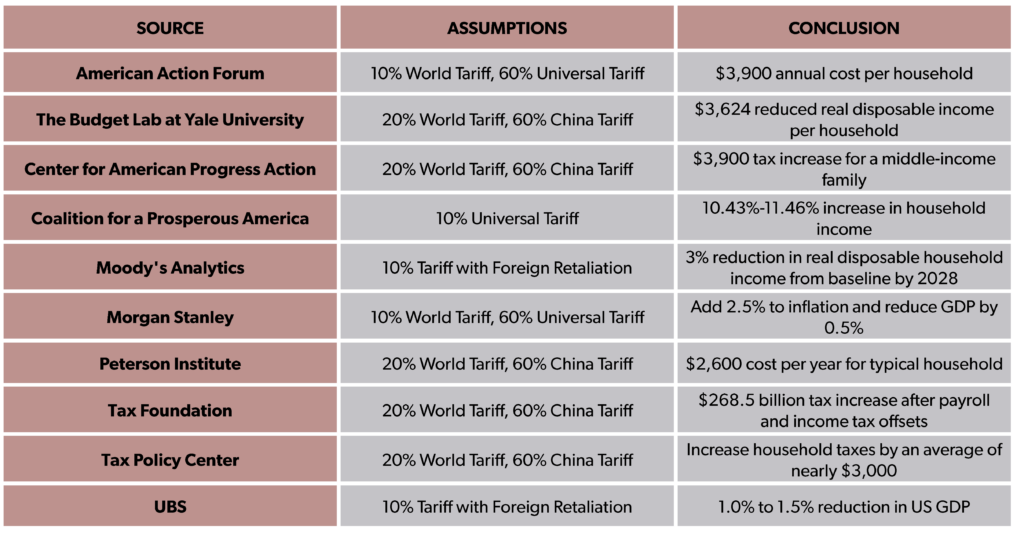

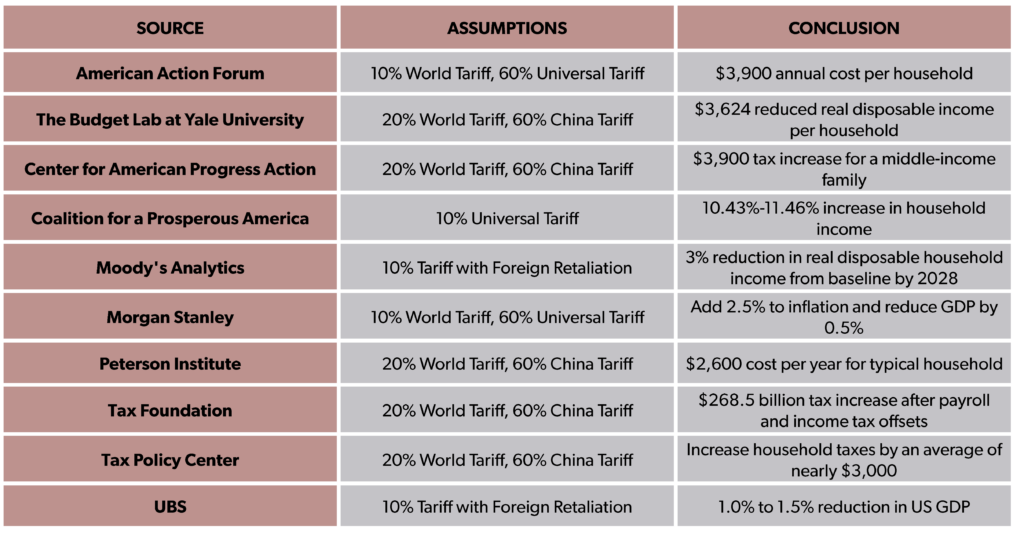

These estimates rely upon many variables that will not be recognized for positive till an government order or tariff laws is made public, in fact. However there’s broad settlement amongst economists that higher tariffs will make Americans poorer—the one query is by how a lot? Here is a tidy abstract of these calculations, pulled collectively by the Nationwide Taxpayers Union Basis:

Procedurally, passing tariffs via Congress would give them extra legitimacy than in the event that they had been imposed solely by the manager department. That has upsides and disadvantages.

If the tariffs are handed as a part of a broader tax invoice, their influence might be blunted by the extension of the decrease particular person revenue tax charges. Individuals would nonetheless be paying increased costs for a lot of items, however no less than they would not additionally be hit with a better tax invoice from the IRS.

Additionally, the legislative course of might whittle down the influence of the tariffs, as lobbyists for affected industries would definitely work exhausting to create loopholes and carveouts within the ultimate product.

After all, that results in one of many downsides: any particular therapy afforded to sure industries would go away a comparatively increased tariff burden on companies with much less affect in Washington.

One other draw back is the truth that tariffs imposed by laws can be tougher to undo, as the subsequent president could not merely wipe them off the books unilaterally (in fact, that in all probability would not occur anyway, because the Biden administration demonstrated).

There are a number of transferring components right here, and there is nonetheless time for Trump to rethink this silly concept—or for his advisors and key figures in Congress to speak him out of it. The one factor we all know for positive is that, if extra tariffs are headed our means in 2025, customers may have the least affect over the method and can find yourself bearing many of the value.