The Royal Swedish Academy of Sciences awarded the Sveriges Riksbank Prize in Financial Sciences in Reminiscence of Alfred Nobel 2024 to three American economists whose work established the vital function of inclusive financial and political establishments for ending humanity’s state of abject poverty. The winners are MIT economists Daron Acemoglu and Simon Johnson, and College of Chicago economist James Robinson—all three are immigrants to this nation.

The Nobel committee centered on the economists’ analyses of how variations in European colonial establishments affected the eventual prosperity (or not) of areas colonized by varied European international locations. Nonetheless, it’s value noting that the institutional adjustments that spark sustained innovation and financial development first occurred in a couple of of these colonizing international locations. Classical liberals and libertarians have lengthy endorsed the Nobelists’ major declare that international locations that advanced inclusive establishments, e.g., free markets, property rights, the rule of regulation, and democratic governance will are likely to prosper. Whereas people who retain extractive establishments will stay caught in immemorial poverty. Because the researchers present, colonized areas to which inclusive establishments had been exported have tended to prosper whereas these on which extractive establishments had been imposed haven’t.

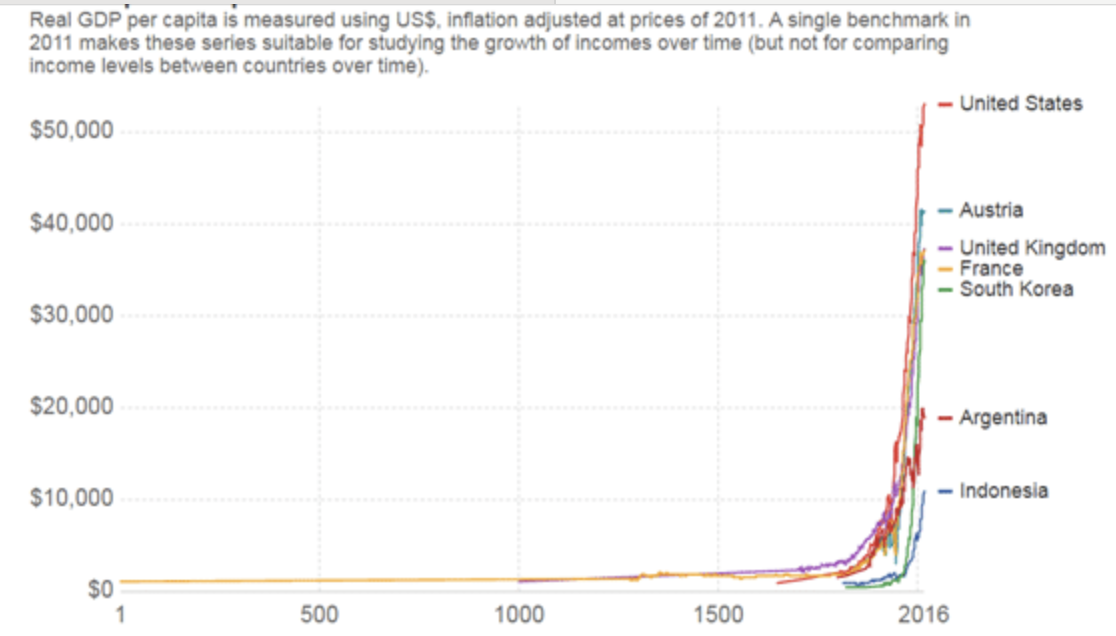

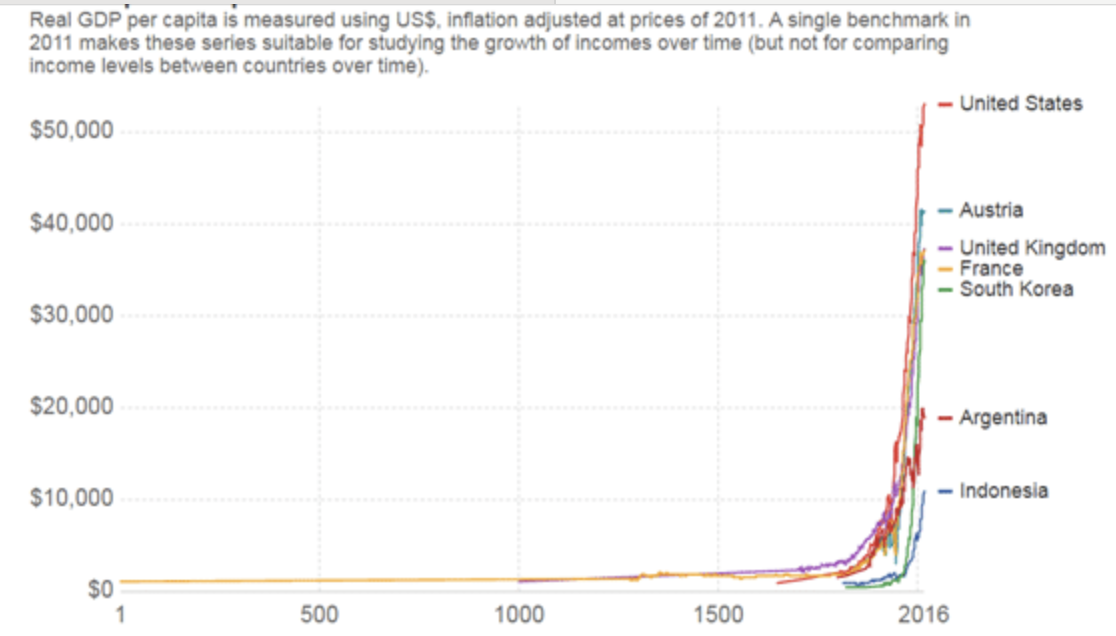

Doubtlessly, variations in colonial settlement and administration have had a profound impact on financial and political outcomes in previously colonized areas. It’s, nonetheless, essential to remember that till a few centuries in the past, primarily all human societies had been based mostly on extractive establishments that mainly benefited political elites, e.g., monarchs, aristocrats, and finally Soviet commissars. Because of this, the pure state of humanity was abject poverty as long-run per capita earnings information from the Maddison Project demonstrates.

Solely with the arrival of what the Nobelists name inclusive political and financial establishments in a couple of Western European nations two centuries in the past did per capita incomes start a sustained rise anyplace on the earth. In my evaluate of Acemoglu and Robinson’s Why Nations Fail: The Origins of Power, Prosperity and Poverty, I summarized their insights:

Each set of extractive establishments is extractive in its personal method, whereas all units of inclusive establishments are inclusive in just about the identical method. For instance, historic Rome ran on slavery; Russia on serfdom, Imperial China strictly restricted home and overseas commerce; India depended upon hereditary castes; the Ottoman Empire relied on tax farming; Spanish colonies on indigenous labor levies; sub-Saharan Africa on slavery; the American South on slavery and later a type of racial apartheid not all that not like South Africa’s; and the Soviet Union on collectivized labor and capital. The main points of extraction differ however the establishments are organized to mainly profit elites.

So why do not extractive elites encourage financial development? In any case, development would imply extra wealth for them to loot. Acemoglu and Robinson present that the establishments that produce financial development are inevitable threats to the facility of reigning elites. The “key thought” of their principle: “The concern of artistic destruction is the primary motive why there was no sustained enhance in residing requirements between the Neolithic and Industrial revolutions. Technological innovation makes human societies affluent, but additionally entails the substitute of the previous with the brand new, and the destruction of the financial privileges and political energy of sure folks.” Thus all through historical past reactionary elites naturally resisted innovation due to their correct concern that it could produce rivals for his or her energy.

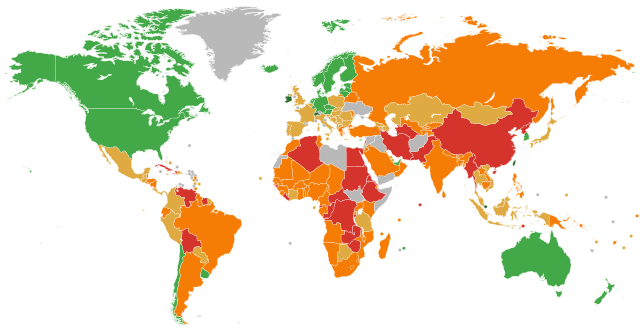

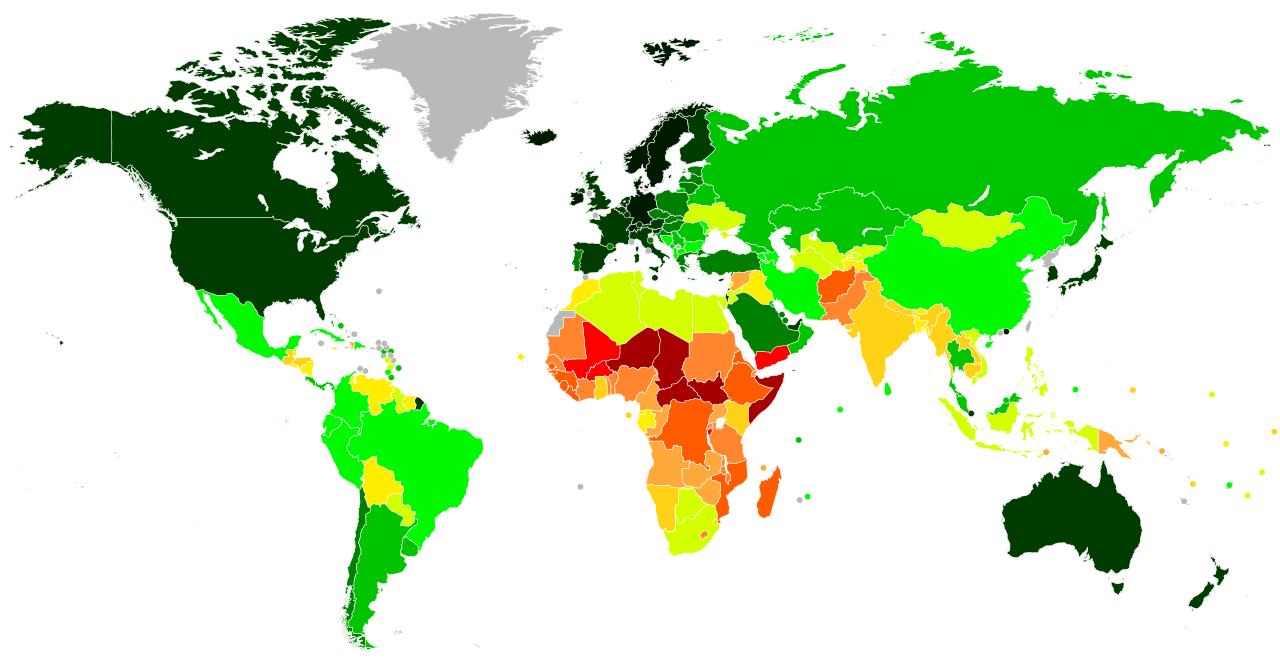

The Financial Freedom Index, issued yearly by The Wall Road Journal and the Heritage Basis, combines scores accounting for the prevalence of free markets and commerce, the rule of regulation, authorities measurement, and regulatory effectivity in every nation. This principally tracks the inclusive establishments that the three Nobelists determine as important to selling financial development and democracy. On the map under, gradations from inexperienced to purple point out lowering financial freedom.

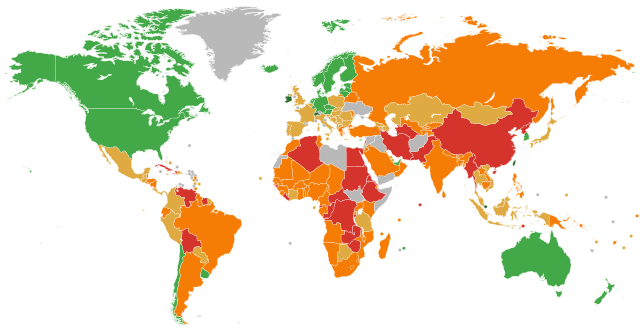

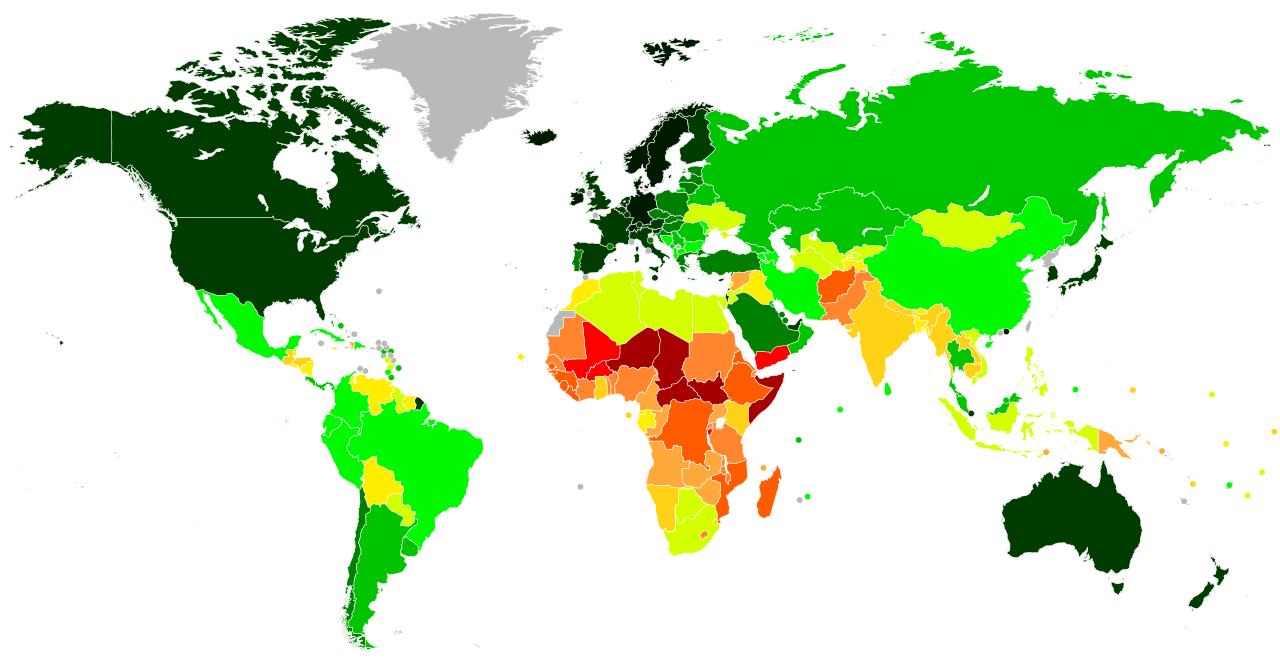

The Human Improvement Index scores are a composite of per capita earnings, common instructional achievement, and common life expectancy. Darker colours point out increased HDI scores.

In fact it’s no shock to libertarians and classical liberals that top HDI scores correlate fairly properly with excessive financial freedom index scores. Sadly for the billions nonetheless residing in poverty, the Financial Freedom Index has lately fallen globally to a 23-year low.

Oddly, superb financial historian Deidre McCloskey in her current column for the Brazilian publication Folha denounces Acemoglu a “statist Nobel.” She claims that Acemoglu believes that “the state is all clever.” Contrariwise, Acemoglu and Robinson each flatly assert, “You’ll be able to’t engineer prosperity.” In Why Nations Fail, the 2 write: “What may be performed to kick-start or maybe simply facilitate the method of empowerment and thus the event of inclusive political establishments? The trustworthy reply in fact is that there isn’t a recipe for constructing such establishments.” These observations are usually not all that statist. Her tight concentrate on the cultural roots of liberalism has maybe led her to misconstrue as someway “statist” an institutionalist account of how financial liberty produces prosperity.

As I famous in my evaluate, Acemoglu and Robinson

… do maintain out a faint hope that the unfold of media and data expertise will allow folks to extra simply kind the types of pluralistic coalitions that may finally generate inclusive political and financial establishments. As well as, info expertise may also produce a sort of demonstration impact by which folks can see how inclusive establishments function.

Acemoglu and Robinson have convincingly recognized the treatment for poverty, however nobody has but found out the best way to get the sufferers to take the drugs.

Nonetheless, the three Nobelists deserve congratulations for his or her work exhibiting how establishments that foster financial and political liberty are the one solution to generate sustained prosperity and improve human flourishing.