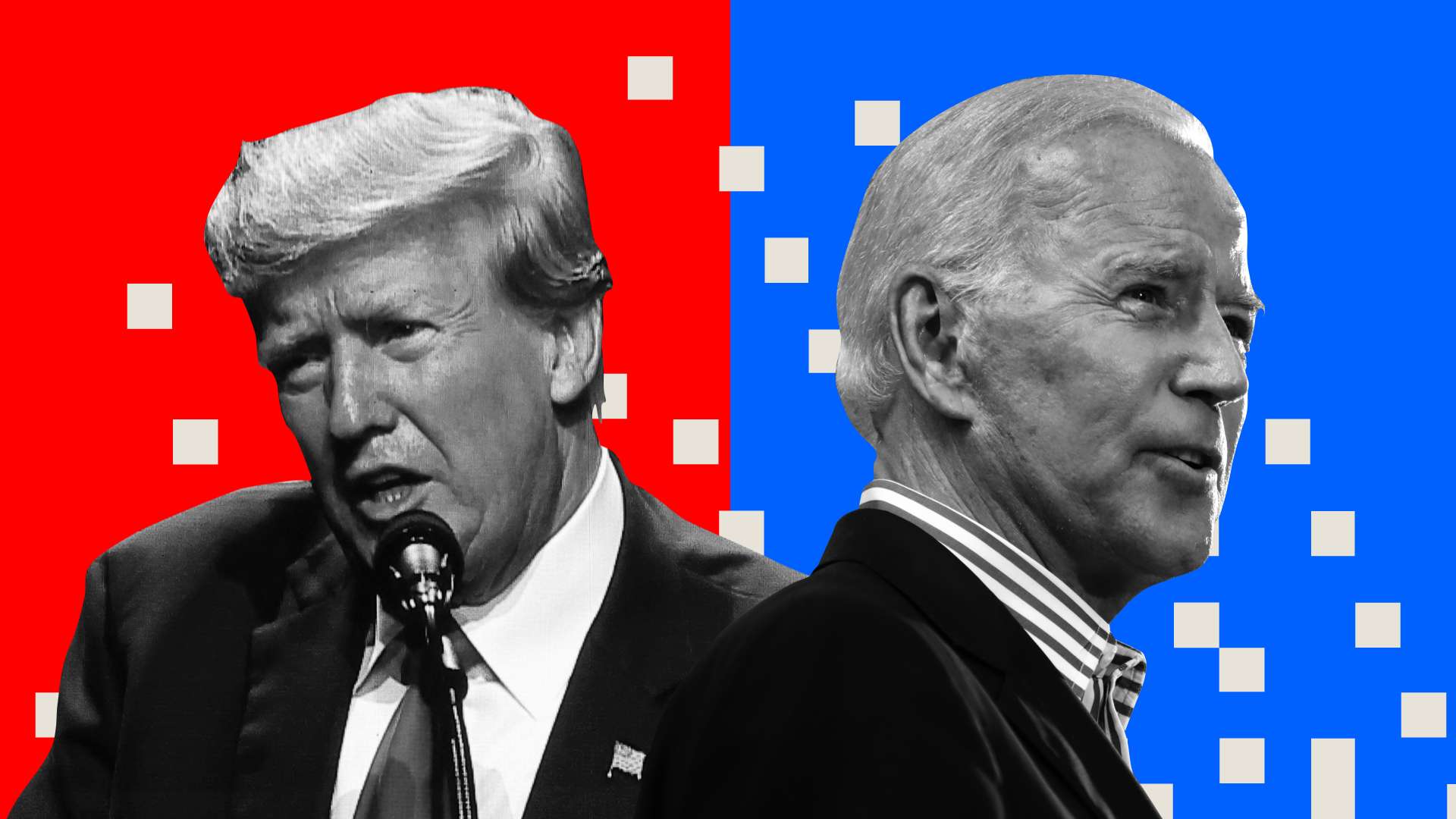

Amidst marketing campaign discord, a bipartisan thought is rising: America can put aside taxpayer {dollars} for particular initiatives and model it a nationwide “wealth fund” to assist enhance public notion of the nationwide debt and deficit spending.

Talking on the Economic Club of New York final Thursday, former President Donald Trump requested, “Why do not we now have a sovereign wealth fund? Different nations have wealth funds. We now have nothing.” He recommended that this new account can be capitalized with “super quantities of cash” that the federal authorities would absorb by imposing tariffs and “different clever issues,” and that the US would have the “best sovereign wealth fund of all of them.” How large would possibly or not it’s? Trump didn’t specify, however stated he would seek the advice of with billionaire hedge fund supervisor and adviser John Paulson. In a separate interview, Paulson said, “it will be nice to see America be part of this occasion and, as a substitute of getting debt, have financial savings.”

An interesting aspiration to make certain, although scarcely conceivable within the foreseeable future. He referenced Norway’s $1.7 trillion wealth fund as a possible aim. That will sound like some huge cash—till one considers that the U.S. federal authorities spends that a lot in simply 4 months. It’s laborious to fathom how it will be the idea of a long-term and significant retailer of nationwide wealth within the context of the U.S. financial system. (Norway has a inhabitants of simply 5.6 million, so it’s totally significant there.)

A fund that measurement would quantity to barely 4 % of the collected $35 trillion U.S. nationwide debt. Trump predicted that the proposed wealth fund would “return a big revenue,” which might assist pay down the debt. That revenue must be gigantic certainly—on the order of a 20-fold return, and shortly—to offset our nationwide debt. And that is assuming the debt did not proceed to extend within the meantime on account of our structural deficits, at the moment operating within the vary of $2 trillion yearly. We’re successfully including greater than a complete Norwegian wealth fund to the nationwide debt yearly. Within the annals of investing historical past, it will be a reasonably spectacular achievement for a pool of capital to understand at a fee ample to offset our preexisting and accumulating debt, if not completely unprecedented at this scale.

As for the Biden-Harris Administration, Bloomberg reports that “prime aides to President Joe Biden have been crafting a proposal to create a sovereign wealth fund,” which they’re wanting to formalize within the remaining months of the administration. Whereas senior administration aides are reportedly debating “the scale, construction, funding, management, and potential guardrails for a proposed fund,” no particulars have been supplied on the way it could be doable to capitalize it.

Paradoxically, throughout the Financial Membership luncheon’s query and reply interval, it was Trump’s adviser Paulson himself who stated that below Trump’s financial plan, the deficit “would come down from gadgets akin to elevated income from tariffs” however can be offset by misplaced income from not taxing ideas. “What do you estimate would be the influence of the fiscal deficit out of your insurance policies?” Paulson requested the previous president. Trump responded that the nation’s present deficit is “loopy…it is simply horrible truly,” however he didn’t point out how or by how a lot it’d decline, not to mention flip right into a surplus below his management.

Except Trump has such a plan, the possible returns of this new wealth fund must be much more implausibly grandiose to contribute to our wealth relative to the magnitude of debt we proceed to incur. And observe from Paulson’s query, in his considering, he has apparently already allotted the anticipated new tariff revenues to comprise the annual deficit, to not be the seed capital of our new nationwide wealth fund as Trump recommended. Fiscal realities being what they’re, this can be very unlikely that discretionary funds of that magnitude shall be accessible to the federal government anytime quickly. With out a substantial reset of the U.S. budgetary construction, an American sovereign wealth fund may possible be launched solely with borrowed cash.

However the inherent contradiction of launching a supposed “wealth fund” with borrowed cash, it will not be surprising if bipartisan political momentum takes us there.

Along with pretending that wealth may be created by means of slogans, each Biden and Trump appear particularly allured by gaining access to a newfound retailer of “wealth” for their very own favored priorities, exterior common congressional oversight. Biden officers reportedly assume this fund may “assist bolster US pursuits by offering first loss fairness capital, ensures, or bridge financing to illiquid however solvent firms competing with Chinese language corporations.”

Trump, for his half, stated he seeks to “construct extraordinary nationwide growth initiatives in all the pieces from highways to airports and to transportation, infrastructure—all the future. We’ll have the ability to spend money on state-of-the-art manufacturing hubs, superior protection capabilities, cutting-edge medical analysis and assist save billions of {dollars} in stopping illness within the first place.”

So, there’s unity in any case. Each events are wanting to create new language to cover our fiscal issues whereas directing a number of trillion {dollars} to probably the most advanced financial initiatives possible with out oversight. Who says the 2 events cannot work collectively?